In 2011, I started my investing journey by opening a Roth IRA at Edward Jones. I was in my final year of college pursuing a degree in electrical engineering. Mrs. Nine to Thrive had just graduated and was making decent income as a radiologic technologist at the local hospital, so we decided to start investing our extra savings.

While most people are whining and being complainy-pants about the amount of student loan debt they’re in, we were able to get through college debt free and begin our path to financial independence.

The Start at Edward Jones

In 2011, I opened an account at Edward Jones. Having never invested before, and not knowing what the heck I was doing, I reached out to a family friend who was a financial advisor at Edward Jones. I set up a phone call with him, and we talked about my goals and my risk tolerance. He suggested that I invest in mutual funds from Franklin Templeton.

Here’s the inside scoop on Edward Jones. The financial advisors are trying to balance the needs of their clients with making a commission for themselves. Therefore, the funds they recommend will always have fees associated with them. In this case, Franklin Templeton funds had a 5.75% front end load. Meaning the $3,000 I thought I was investing was actually $3,000 – 5.75% = $2,828. On top of that, Edward Jones charges a $40 annual fee. So really, I was only able to invest $2,788.

Dang. Forking over $212 just to invest my money seemed like a lot to me. But at the time, I didn’t think twice about the fees, believing that’s just how investing works. I was also assured by my financial advisor that the funds recommended to me would outperform the market (Lies! More on that later).

The Problem with Edward Jones

You’d think by using a “professional” and paying all this additional money in the form of fees, you’d have access to the best of the best of mutual funds. The funds they recommend should far surpass the returns of the Dow Jones or S&P 500 right?

Wrong! That’s far from true. 92% of actively managed funds (everything that will be recommended to you at Edward Jones) fail to beat the S&P 500. If you hold your investment accounts at Edward Jones, not only will you be forced into investing in actively managed funds that likely won’t outperform the market, but you’ll be paying expensive fees on top of it!

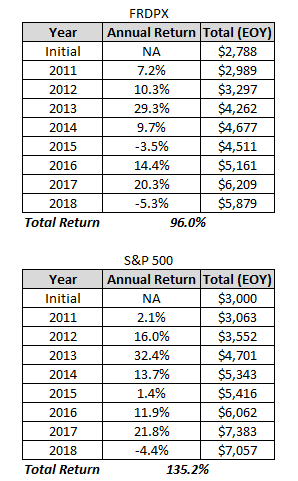

Take a look at the chart below. In 2011, the “Franklin Templeton Rising Dividends” mutual fund was recommended to me (FRDPX). Compare the gains of this fund versus the S&P 500:

From November 2011 to October 2019, the S&P 500 (GSPC) is up 138.2% versus 95.47% for FRDPX. Note that these returns do not include dividends.

This comparison doesn’t even account for the fact that I automatically started in the hole with all the fees that Edward Jones charged.

See below for what this looks like in real dollars. Note that the returns below include dividends.

Wowza, after seven years, the S&P 500 has already outgained that “professionally” recommended mutual fund by over $1,000.

Still think it’s worth using Edward Jones? After looking at the numbers myself, I didn’t think so.

Why Vanguard is Better

Jack Bogle founded Vanguard in 1975, and the company is client owned and operated at cost. This makes Vanguard unique from every other investment firm out there.

Edward Jones on the other hand, is a privately owned company. The owners (shareholders) of Edward Jones expect a return on their investment. This return on investment comes from the revenue that Edward Jones generates from the fees associated with their accounts and commissions you pay when buying a mutual fund.

When you own a mutual fund at Edward Jones, you are paying for the profit that goes to the Edward Jones shareholders (owners). So obviously the shareholders at Edwards Jones want the fees to be as high as possible, which results in higher returns on their investment, not yours.

Vanguard, is operated at cost. Vanguard has no shareholders to answer to. The profit that the company makes gets redirected back into its mutual funds. Resulting in mutual funds with extremely low expense ratios (an expense ratio is the cost needed to manage a mutual fund).

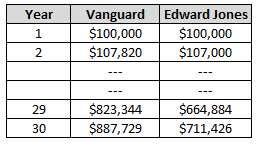

The average expense ratio at Vanguard is 0.18%. The industry average is over 1%. You may think meh, 1% isn’t that big of a deal, I think I’ll stick with Edward Jones. All things considered equal, here’s what the difference looks like after 30 years:

That 1% expense ratio could be the difference of over $176,000!! And that’s not even considering the front end load fees of 5.75%, or the fact that the funds at Edward Jones underperform those at Vanguard.

Does this Guy Have an Affiliation with Vanguard?

Nope! I’m just trying to help people from making the same mistake that I did by using Edward Jones. I would have been so much further along on my financial independence journey if I would have used Vanguard from the start.

Vanguard doesn’t know I’m writing this and I have no Vanguard advertisements on my blog. Vanguard does not pay me in any fashion.

Transferring Your Money to Vanguard

This past year, I transferred my investment accounts from Edward Jones to Vanguard. It was a relatively straight forward process. You can start the transfer on Vanguard’s site. For my account, I was able to complete the process 100% online. However, for some accounts, you may need to fill out some paperwork and talk to someone at Edward Jones before transferring your account.

Which Vanguard Fund to Invest in?

I personally invest all of my money in Vanguard’s VTSAX mutual fund. VTSAX invests in every publically traded company in the United States. When you buy VTSAX you are instantly diversifying yourself with stock from over 3,000 U.S. companies.

VTSAX has averaged a 14% return over the last 10 years (we’ve been in a “bull” market), and offers an additional 1.8% yearly dividend. The expense ratio, as you’d expect, is low, at only 0.04%.

Some people are hesitant to invest in stock mutual funds because of the day to day volatility, and I totally get it. But instead of worrying about what happens on the day to day, buy yourself some VTSAX and forget about it. History shows that on average you will average an 8% yearly return.

I also highly recommend using Personal Capital to track your investments and your overall net worth. It’s super easy to use, convenient, and you get a $20 Amazon gift card just for signing up here.

Cheers to Financial Independence!

Related: Is Bitcoin a Good Investment?

I inherited several hundred thousand dollars in an Edward Jones account. I left it in the account for a year because the agent had been good to my dad as his health had declined and hadn’t taken advantage of him. But after that I moved it to Personal Capital which had a statistically backed investment model and lower fees. My experience with Edward Jones was they are great people but their fee structure is too high for my comfort.

Pingback: My Biggest Financial Independence Mistakes - Nine to Thrive

Well written- the only missing component- is the fee is not to “buy the investment”. The fee is for sound guidance, coaching, and counsel. The mistake made is when someone uses an advisor when they do not need advice. For an educated individual who has the interest and time, then selecting a different company with no advice makes clear sense. Anyone can wire, plumb, and build their own home “at cost” as well. Most choose not to. That does not make a home builder or architect high priced. This is a choice between the level of service and advice …not investment cost.

Dear MC,

Thanks so much for explaining the difference between investing with EJ vs Vanguard. You’re absolutely right…those who have the time, temperament and knowledge to develop a sound financial plan SHOULD do so on their own. They don’t need (nor should they pay for) the services of an FA. I am an EJ Financial Advisor, and I explain that to all of my clients. But the reality of the matter is that most folks do not possess these qualities, hence the need for guidance. Indeed, my clients will tell anyone that they could not have achieved the investment success and sound retirements that they enjoy without me. There’s a lot more to financial advice than which mutual fund to pick! To compare fund performance/selection and outcomes by cost only is foolhardy, and doesn’t take into account all the rest of the services provided by an FA, nor investor psychology. The writer fails to grasp that not only do we advise our clients on WHAT to do, we also advise WHAT NOT to do. This becomes especially important when markets are faltering; I have had many a client tell me about a “friend” who took out all of their serious savings dollars when markets corrected, only to lock in their losses and the potential for recouping then. I have great respect for Vanguard…they’re an excellent firm. But they’re not for everybody, and the worst thing that anyone can do is to seek to advise the general public by posing as an “expert” and dole out blanket advice.

I wanted to leave a comment here on your thoughts on Edward Jones vs. Vanguard, or EJ vs. any other firm for that matter. You are absolutely correct that Vanguard is an excellent place to park your IRA as their fees are minimal. As far as your comments on Edward Jones, they are correct to an extent. First, let me start by saying I am a licensed financial professional that is not biased to either of these companies. Like I said before, you are correct on the differences in “fees”, and how they can stack up over ones whole career. However, let me point out that what you mentioned about Edward Jones looking to pick something they can make money off of is simply not true, unless you were just dealing with somewhat of a “bad apple” if you will, that is not adhering to his/her fiduciary duties to you- the client. EJ investment advisors are allowed to pick their portfolios, stock, bonds, indexes, etc. based upon the suitability of the client. You could invest in the same S&P Index with EJ, more particularly- you could even invest in the same Vanguard fund you mentioned with EJ. With reference to the investment advisor, and you mentioning yourself and your significant other being young professionals with great careers with tons of growth potential, I must share that you should have a completely different approach than a simple Franklin Templeton mutual fund. With that, the advantage of having an Advisor is that this person is in your corner and should act on your best interest while reviewing your portfolio quarterly(semi-annually at the least), and making necessary adjustments to yield maximum results- which is one example of having a professional in your corner. I’m not going to go deep into front-end vs. back-end costs of mutual funds, but I do want to say that the little bit you have told about yourself- that mutual fund selection is a HORRIBLE plan. Of course, that’s not your fault- it speaks much more to the knowledge of this particular Edward Jones advisor ability to build a properly structured portfolio. Good luck to you!

Does it cost a fee or penalty to move your money out of Edward Jones?

If your money is in a IRA or Roth IRA and you’re cashing it out, then yeah there are penalties associated with that. However, if you move your IRA or Roth IRA to another firm and keep your money in a IRA or Roth IRA at that other firm, then no you won’t pay a penalty. There also aren’t any fees with moving your money from one firm to another.