It seems like every week I see another article about millennials being broke due to student debt. That doesn’t have to be you. You can, absolutely, get through college without student loan debt. How would I know, you ask?

When I graduated from high school in 2006, I had no job, no bank account, and no savings. Yet, I obtained my bachelor’s degree without a penny in student loan debt. In the paragraphs to come, I will give you the essentials that got me through college debt free:

Keep it Local

Going to an in-state public university might not sound cool, but it’ll save you $16,000 per year (national average). Quite the gut punch isn’t it? Multiply that number by 4 years of college ($64,000), and ask yourself how an out of state school is a good idea. Don’t answer “the college experience,” because that won’t matter when your student loan debt is still haunting you into your 30’s. Don’t start off on the wrong foot by paying $64,000 more for the same education. Check out this handy tuition comparison chart from The National Center for Education Statistics if you are having a hard time believing those numbers.

Work It

When I finished high school with no money saved for college, I knew I had to get serious fast. I only had one summer to get it together. That summer, I got a job making $9.50 an hour (plus tips) as a luggage handler at a hotel. I worked overtime (around 60 hours per week — sometimes more). By the end of the summer, I had $10,000 in the bank. I was lucky to have an employer that allowed overtime. Time and a half is a nice perk. If you aren’t able to find a job with overtime, don’t worry. With a second part time job you’ll still be stashing money like a nutty squirrel stashes its nuts.

I went to the University of Alaska Fairbanks (UAF). Back in 2006, the cost of attending college was around $6,000 a year. Current tuition at UAF is $8,000 a year, about 33% higher. However, wages have also gone up. In Alaska in 2006, the minimum wage was $7.50 an hour. Today the minimum wage is $9.89. That’s a 32% increase – in line with the increase in tuition.

It’s possible to save enough money to pay for an entire year of college tuition in only one summer. If I was smarter during high school, I would have worked through my summers to save up more over time. But, I still pulled it off with zero planning and zero money to start with. So, no excuses, people!

To pay for living expenses, you will need to get a part time job while going to school. Universities offer a lot of great jobs to their students. In most cases these jobs are flexible and are willing to work with your school schedule. Plus, you’ll already be on campus for classes, so no need to drive across town to get to work. I got a job at the University’s HR department. I worked 20 hours a week making $9.00 an hour. It was mind numbing work, but it was great because I could fit in a couple hours of work here and there between classes.

Cut Costs of Living

Now let’s take a look at the expenses you’ll incur while going to school. First on the list, living expenses. Avoid dorm living if at all possible. It’s expensive and you’re often forced to select an expensive meal plan along with dorm costs. For my first year of college, I lived at home, which cut costs drastically. During my second year of college I made the costly mistake of living in the dorms. After that, I got married and took advantage of on-campus family housing – inclusive of all utilities and furniture. My wife was a student and worked a part-time university job too, so we split the rent of $800 per month. Roommates are the best way to save on rent costs. My “roommate” just happened to be my wife.

Food

Another major cost is food. I was able to get by on $50 a week for groceries. Resist the temptation to go out to eat. It’s okay once in a while, but don’t make it a weekly habit. My poor student eating out hack: Bottomless tostada chips and salsa at Chili’s for $5. My wife and I would eat 2-3 baskets of chips and salsa as our meal. We would get funny looks from the waiter/waitress, but we didn’t care, we were poor and hungry!

Cell Phone

In 2006, smart phones hadn’t been invented yet. I had a Nokia brick phone. On a family cell phone plan I paid $15 a month. Today, you can get a Moto G6 on the Google Fi plan for $99 or $4.12 a month for two years. Google Fi is $25 a month for unlimited calls and text, and $10 for every GB of data you use. A word of advice: don’t be a phone zombie. You should only need 500 MB of data or less per month. That should keep your cell phone cost around $35 per month. If want to use a different carrier besides Google Fi, you can still get the Moto G6 from Amazon here.

Car

If you live within walking distance of the University, and your job is at the university, there won’t be a need to drive around much. It could be argued that you don’t even need a car. Let’s just say you DO have a car and will be paying for gas and car insurance. You should only need around $30 a month for gas, and $25 a month for car insurance.

School Books

You’ll need books for your classes, which can be a major expense if you buy new books from the University book store. You can find used books on Amazon or Ebay, and save even more money buying older editions (just be prepared for some discrepancies). Also, Amazon offers text book rentals for awesome deals, so check that out too. Using these cost saving tips, you’ll only need $400 per year for books.

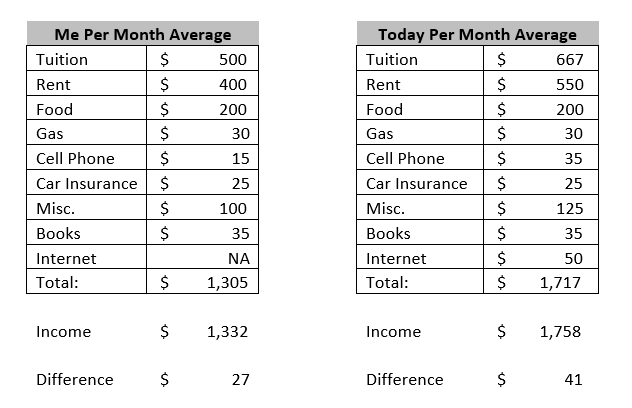

Now let’s see if our monthly income is more than our monthly expenses. Below, I have two tables. The one on the left shows my income and expenses during college averaged on a per month basis. The table on the right shows numbers adjusted for today. In the table you’ll see a line for “Misc.” expenses. When budgeting, I always include an 8% contingency for unforeseen miscellaneous expenses, and you should too. Check out my budgeting post for more info.

Based on these tables, you’ll notice that the average monthly income in both cases is greater than the monthly expenses. This is good news! It means you can pay your way through school on a part time job. Also, don’t forget that killer stash of savings from the summer!

If you’re able to survive the first year of college without taking out student loans, the remaining years will get easier. You may get scholarships for good grades, or obtain grants through financial aid. You may also find better paying jobs. The summer before my last year of school, I was offered an internship paying $14.75 an hour. During the school year, I got another internship paying $22 an hour. After the first year, it will get easier, trust me.

I hope this article inspires you and proves that it is possible to tackle college without loans. Starting your career without debt will set you up for future financial success. Early retirement and financial freedom are easier to attain without the crushing weight of student debt!