Budgeting…. everyone’s favorite topic *insert sarcasm*. Americans are notoriously bad at budgets, so it’s usually a sore subject, but a necessary one.

Multiple surveys show that the majority of Americans have less than $1,000 in savings. How can this be!? A huge reason for this: Americans have been conditioned for instant gratification. Want a new car? Easy, take out a loan. How about a new phone? No problem, there’s a payment plan for that.

“We buy things we don’t need, with money we don’t have, to impress people we don’t like”

Budgets are like dams. They stop the free flow of cash and harness its power through controlled flow. In this post, I’ll teach you how I harness the power of the dam budget (laugh – it’s funny).

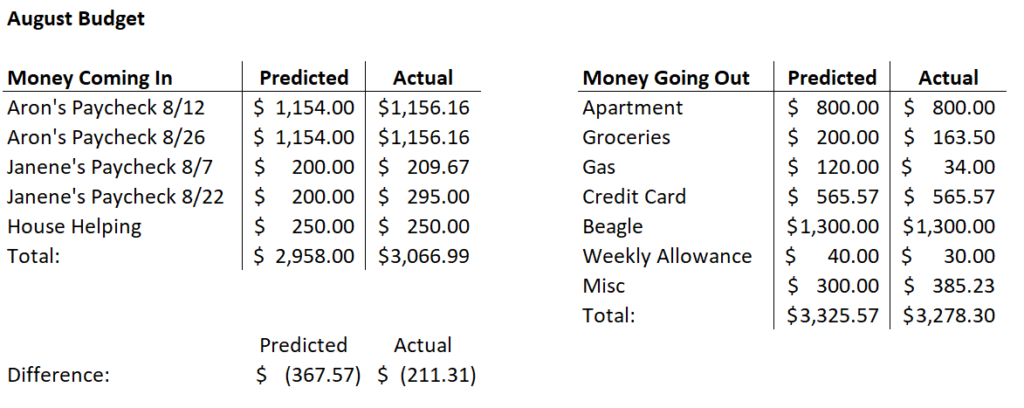

In 2011, I was inspired by Dave Ramsey’s book The Total Money Makeover to start my first budget. Here it is:

Ahhhh…a trip down memory lane. At the time, I was working as an intern at the University’s power plant going into my last year of college. My wife had just graduated with a degree in radiologic technology and was working part time at an Urgent Care clinic. You might notice we spent more than we made. That month we rescued a beagle from the shelter, and our apartment required a hefty pet deposit (which we saved up for.) That little snuggle monster was well worth it.

If you aren’t already tracking your spending every month, start now. You should set up your budgeting spreadsheet at the beginning of every month. If the money you’re making is less than your expenses, you have a problem. We can change that!

Common reasons why your expenses are too high (beagles excluded):

1. You Have a Car Payment.

If you can’t afford it, don’t buy it. A car will always lose its value while crippling you with a monthly payment – this is one of the worst financial mistakes.

Meet Jim Bob. He buys a car for $30,000. He chips in $5,000 as a down payment and gets a $25,000 loan with a 3% interest rate. His monthly car payment is $450. After 5 years his car is paid off but is now only worth $10,000 if it’s in good condition. Over those five years, Jim Bob has lost almost $17,000:

$26,953 (loan principal plus interest) – $10,000 (car worth after 5 years) = $16,953

Now let’s rewind.

Meet Jim Bob. He spends his $5,000 to buy a used car. The extra $450 he saves per month goes to an index mutual fund generating 8% yearly returns. After 5 years, Jim Bob has $34,000. Jim Bob continues to do this and after 30 years with the power of compounding interest he has $660,000. Be like Rewind Jim Bob. He’s smart.

2. You have the latest cell phone and an unlimited data plan:

I get it. Your new phone is fancy and makes you feel super cool. You need unlimited data so you can use your fancy phone anytime, anywhere. Actually, I lied – I don’t get it. Here’s why:

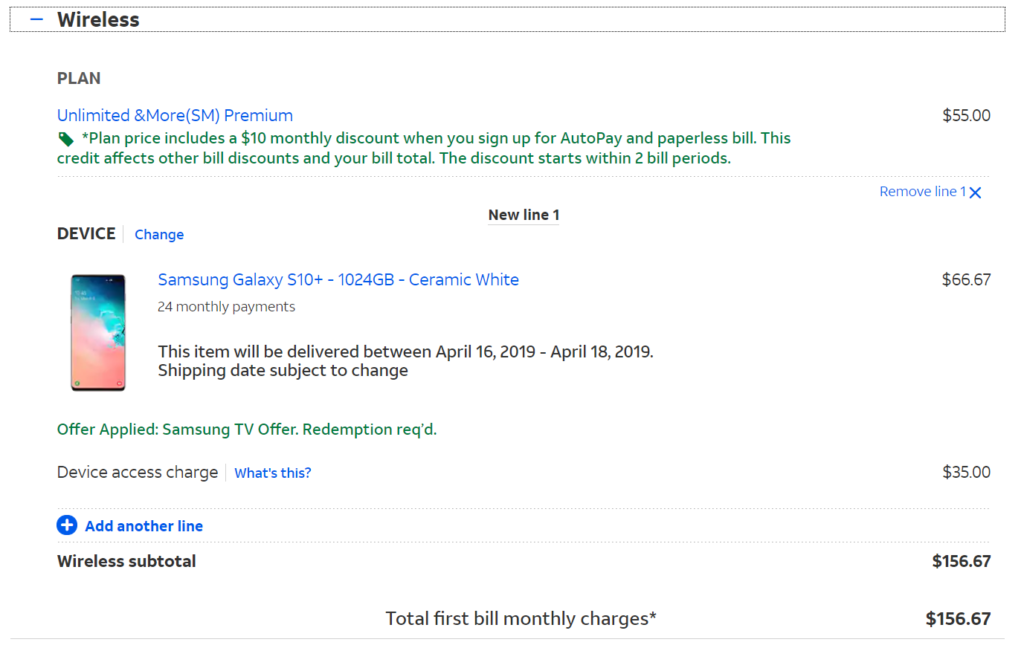

I looked up what the monthly cost is for getting a Samsung S10 with an unlimited data plan at AT&T – $156.67 a month (see below):

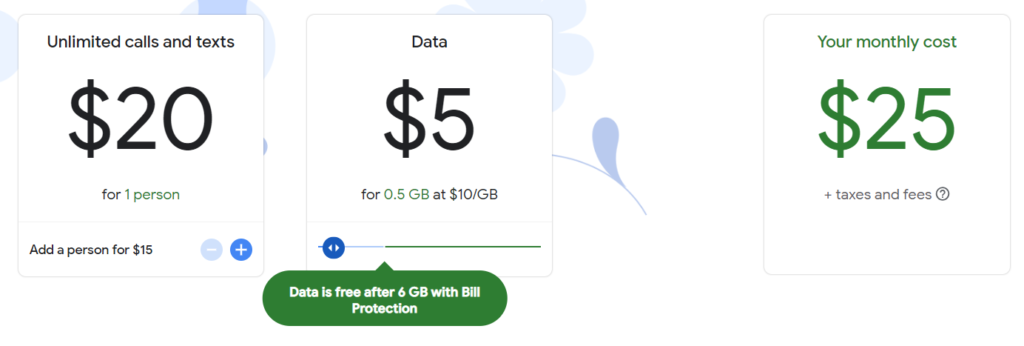

Instead, you could buy a Moto G6 from Amazon outright and get a plan on Google Fi. Unlimited call and text is $20 a month. Every GB of data you use is $10 a month and is free after you use 6 GB. But who needs all that data? You should be doing more productive things with your time instead of being a phone zombie. 500 MB of data a month is plenty. This plan will cost your $25 a month.

That’s a net difference of $130 a month. Take that extra $130 and do like Rewind Jim Bob – invest in an index mutual fund. After 30 years you’ll have close to $200,000.

3. You have cable or satellite with 10 bazillion channels.

Have you ever found yourself flipping through an endless abyss of channels to find nothing worth watching? You end up watching reruns of The Office because “nothing else is on”.

330 channels on Direct TV is $189 a month. Ditch the satellite subscription. You don’t need it! Netflix is $9 a month. After 30 years of investing your savings, you’ll have around $264,000.

The impact of cutting costs in these 3 areas (car loans, phone plans, and cable/satellite subscriptions) is worth your attention. After 30 years in index mutual funds, those savings will grow to over ONE MILLION DOLLARS! That, right there, is why I budget, people. This is the controlled cash flow I’m talking about. Plug up those leaks, and pour that money into investments. There’s no rewind button in real life. So, start a dam budget already, and harness the power. Early retirement is calling your name.

If you have any questions regarding budgeting or want a copy of the budgeting spreadsheet I use, feel free to contact me.

Are there any apps or programs you would recommend that help create a budget?

I personally use Excel. It’s quick and easy. I’ve heard good things about the YNAB app though. It may be worth checking out 🙂