Everybody loves money. And it doesn’t get much better than easy money. Money that’s given to you, for doing what you do every day anyways.

This past month, I just made the easiest $500 I’ve ever made in my life.

How you may ask?

Credit card sign up bonuses.

Easy Money From Credit Card Churning

Up until this year, I’ve only had one credit card my entire life. The Alaska Airlines mileage card. Growing up in the middle of nowhere, Alaska, the only airline that flew in or out of my town was Alaska Air. I used the miles I gained from using my credit card for mileage tickets. At the time, I thought this was amazing. I mean free airline tickets? C’mon now, it doesn’t get much better than that.

Or so I thought…

Credit card churning has been around for a while now. The idea is, you sign up for a credit card, use the credit card until you get the sign up bonus, and after you’ve received the sign up bonus, you cancel the card. Seems simple enough, right?

I’d heard of credit card churning in the past, but I didn’t think the effort was worth the reward. I had also heard tales of credit scores going into the tank after cranking through so many credits cards.

But after looking into credit card churning a little more, I hopped on the bandwagon. And I wish I would have made the jump years ago. The sign-up bonuses you receive from credits cards can be equivalent to thousands of dollars per year in travel rewards and cash back.

Janene and I are planning on taking a vacation next year using only the travel rewards/cash back we’ve received from credit cards.

The Process Begins:

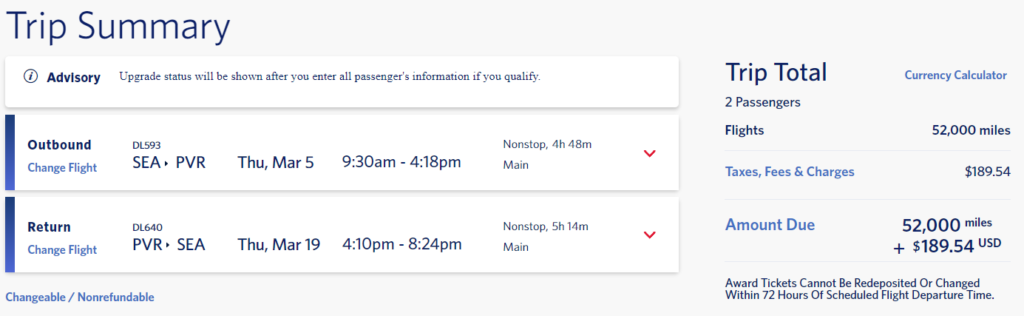

I started credit card churning in March. Delta airlines had a promotional offer on their Delta Gold Skylines card: 60k miles for spending $2,000 in three months. An added bonus is the annual fee is waived for the first year.

And a few months later: Success!

I’m not sure where we’ll go yet, but we now have enough miles to get two tickets to Mexico which doesn’t sound too shabby.

Up Next, My Easy $500

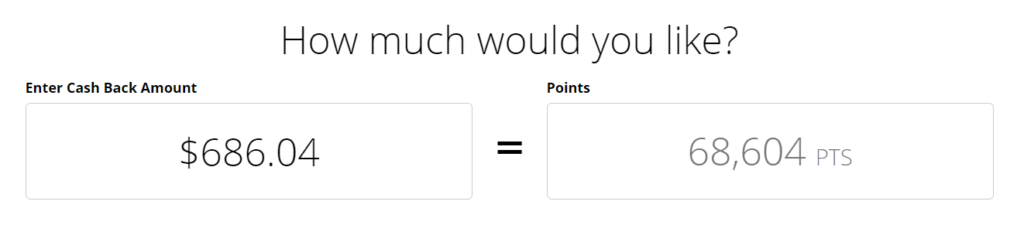

Then in May I signed up for the Chase Sapphire Preferred card. This card offers 60,000 points if you spend $4,000 in the first three months. The card does have a $95 dollar annual fee. But the 60,000 points is worth $600 cash back!

And again, a few months later, I get a prompt asking how much cash I would like back:

I’d like it all! Give me all the cash back!!! Muahaha….

$686 cash back reward – $95 annual fee = $591. The easiest money I’ve ever made.

Your points are actually worth 25% more if you redeem them for travel (airline tickets, hotels, rental cars, excursions…) But who doesn’t like straight up cash!?

Thank you sir, I’ll have another…

Next Up

Currently I’m using the Capital One Venture card. The annual fee is waived for the first year and it offers a 50,000 mile sign up bonus if you spend $3,000 in the first three months.

The 50,000 miles can be used for $500 in travel expenses.

The Downsides

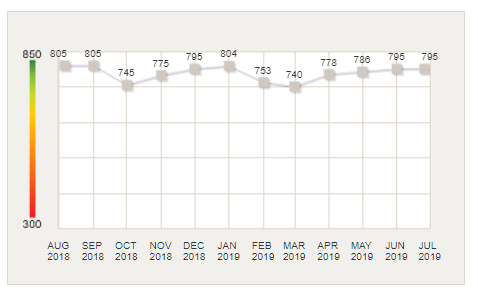

I previously mentioned how I was hesitant of credit card churning because I’d heard that it lowers your credit score.

But since March, my credit score has actually gone up…

I should mention that you need good credit to begin with in order to get approved for these cards.

And you should pay the cards off in full every month. The whole reason why credit card companies are able to offer these amazing sign up bonuses in the first place is because of people not paying off their credit cards in full every month.

Don’t be the person that funds other people’s vacations with your interest payments and late fees!

As an added bonus, some cards have referral programs, which you can use to get even more points/miles by referring the card to friends and family. The Delta Skymiles, Chase Sapphire, and Capital One Venture cards all have referral programs (yay!).

Summary

Gold Delta Skymiles

Sign Up Bonus: 60,000 miles (promotional, normally 30,000 miles)

Annual Fee: None ($95, but waived the first year)

Spend for Bonus: $2,000 in 3 months

Sign Up Bonus: 60,000 points ($600 cash back)

Annual Fee: $95

Spend for Bonus: $4,000 in 3 months

Sign Up Bonus: 50,000 miles (Equivalent to $500 of travel rewards)

Annual Fee: None ($95, but waived for first year)

Spend for Bonus: $3,000 in 3 months