You don’t need a be a millionaire to be happy. And you don’t need to be a millionaire to retire early. I like to think of reaching early retirement as a game. You start the game when you join the workforce, and the game ends when you’ve accumulated enough wealth to be financially free for the rest of your life.

The problem with this game is you aren’t taught the rules. On top of not knowing the rules, society tells us that retiring early is only something the ultra-rich can attain. Or we need fancy clothes, the latest phone, and a shiny new car to prove our worth to others. I’m here to tell you that none of this is true. Retiring early is possible on an average income, you just need to know the rules to the game. Enter Rule #1: Minimalism.

Materialism Doesn’t Bring Happiness

Have you ever been standing in your closet, looking at your clothes filling the shelves, and still you feel like you have nothing to wear? Where did all these clothes come from? Advertisers do an amazing job of getting us to buy things by playing with our emotions and our desires to feel accepted and successful.

I remember in high school wanting to be part of the “cool kid” crowd. What did the “cool kids” wear? American Eagle, Hollister, and Abercrombie & Fitch. What did I do? Bought the same clothes as the cool kids in an attempt to fit in (spoiler alert: it didn’t work).

Fast forward to adult years, and the same concepts apply. LeBron James drinks Sprite? I can drink Sprite and be like LeBron James! Matthew McConaughey drives a $50,000 Lincoln MKZ? I could totally afford that with a car loan and be super rad just like Matthew McConaughey! Alright, alright, alright…

I’m here to tell you; don’t fall for the traps that society is setting. These advertising games are like “Go to Jail” cards in Monopoly. They are set backs on your path to financial independence.

Take a step back and think about it. Do new clothes make you happy? Maybe, for a short period of time. But after that brief period of time fades away you’ll be left standing in your closet with “nothing to wear” all over again. Not soon after, you’ll be emptying your pocket book to feed your materialistic addiction and the vicious cycle starts again. And as the years go by, you’ll be looking to escape your nine to five job, left with no savings, no plan to reach financial freedom, and wondering how you’ll ever get out.

Minimalism Enables a Path to Early Retirement

Part of the early retirement game involves changing your mindset. Society has conditioned us for instant gratification. We’d rather have what makes us happy in the short term instead of what’s good for us in the long term. We need to overcome our instant gratification conditioning and start thinking about how this will affect us long term.

Before making a purchase, ask yourself, “Is this something that will continue to bring me happiness 1 year from now? 5 years from now? Or am I better off investing this money in myself, allowing for a faster path to financial freedom?”

Consider the example of buying a new car. Will you still be happy with your new car 1 year from now? Maybe. 5 years from now? Doubt it. This money would have been better off investing in your financial freedom.

It’s important to note that there is a fine line between minimalism and deprivation, and it will be different for everyone. The important thing is to recognize your spending habits and make the determination of whether you’re truly gaining happiness from your purchases.

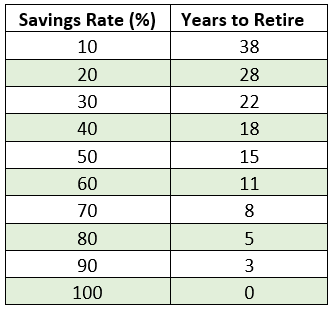

So how does an average income earner use the minimalism rule to win the financial independence game? The first step is budgeting and finding your savings rate. Your goal should be to have a savings rate of 40-50%. With this kind of savings rate you can expect to retire in 15-18 years. Not able to save that much? Don’t fret! Even with a savings rate of 10-20% you’ll be light years ahead of most. Check out the table below to see how your savings rate affects your years to retirement. Note that the table assumes a 4% withdrawal rate and yearly investment returns of 8%. Check out my early retirement post for more info.

Minimalism Allows for More Time

When you de-clutter your life of material possessions you’ll find yourself with more time. And when you become financially independent, you’ll have all the time in the world. Your years spent working can distract you from what’s most important in life: Relationships. If you are in the U.S. and making more than $50k per year, you are in the top 1% of wage earners on the entire planet. Consider yourself blessed. Spend your time and money on developing relationships, helping others, and bettering the world.

A 75 year study (check out the TED Talk here) on adult development found that it wasn’t fame and fortune that led to a happier life (shocker). Those who are happiest are the ones that maintained deep, meaningful relationships over their lives.

If you enjoy your daily or weekly coffee from Starbucks, that’s fine. But instead of going alone, what if you started inviting a friend every week to join you? Instead of going out to eat with just your spouse, why not invite another couple with you?

We can further change our mindset when purchasing something and thinking about the impact it will have on those around us. Ask yourself, can this purchase in some way help others?

To quote one of my favorite movies of all time, It’s a Wonderful Life “No man is a failure who has friends.”