Rental property income is a powerful way to generate income during your retirement years. Finding the right property to begin with is key, and it takes a lot of due diligence and planning. Passive rental property income is part of my fail safe plan of early retirement that will allow my wife and I financial freedom at 40. Check out my retirement plan post for more info.

Rental income can be a tricky game if you don’t start out with the right property. In this post I hope to educate you on how I analyze rental properties in order to determine whether or not they’ll make a solid investment.

We bought our first duplex in 2017 after a year of planning and waiting for the right property. We analyzed countless properties during this time, which allowed us to hone in the method I’m about to teach you. This analysis technique will allow you to take the emotions out (somewhat) of buying a rental property by being able to quantify whether or not a property will be a good investment.

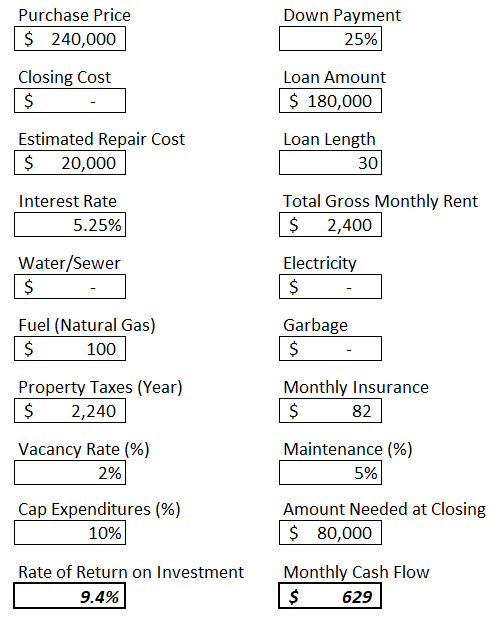

Below is an example of a duplex that we’ll be submitting an offer on. I’m going to show you step by step each of the entries in my analysis spreadsheet, so you’ll be a rental property analyzing wizard in no time!

Feel free to reach out to me, and I’ll send you the spreadsheet I use.

Purchase Price:This one is easy. Fill in the asking price of the property. The purchase price is negotiable between you and the seller, so you can adjust this number if you feel like putting in an offer that’s less than the asking price.

Down Payment: For an investment property, you will typically need a down payment of 25% of the purchase price. This can seem like an insurmountable amount of money when you’re first starting out. If this is your scenario, I recommend finding an investment partner that can provide the funds needed for a down payment.

Loan Amount: The loan amount is the purchase price minus the down payment and is automatically calculated in the spreadsheet. So, in this example $240,000 – 0.25 x $240,000 = $180,000.

Loan Length: Typical loans are either 15 years or 30 years. A 15 year loan will come with a higher monthly mortgage payment, but you’ll get a better interest rate. For a 30 year loan you’ll get a lower monthly mortgage payment but your interest rate will be higher. Personally, I like to use 30 year loans to keep the monthly mortgage payment as low as possible.

Closing Costs: Closing costs vary. In our experience, buying our house and a duplex, closing costs have been around 2.5% of the overall purchase price. Closing costs are something you can also negotiate during the offer. You’ll notice in the spreadsheet above, I don’t have a value for closing costs, because I’m planning on asking the seller to cover these.

Estimated Repair Costs: If you’re buying a property that needs some work, you’ll want to make notes when looking at the property. You can either do the repairs yourself, hire the work out, or do a combination of both. Have a contractor walk the property to estimate the cost of repairs so you have a good idea of what you’re getting yourself into. Doing some of the repairs yourself can save a ton of money. When we bought our duplex in 2017, we did the demo and painted the interior walls ourselves, which saved us about $6,000. We hired a contractor to install new flooring and counter tops.

Interest Rate: For investment properties you’ll pay a higher interest rate than a personal use property. We bought our duplex in May 2017. The personal use mortgage interest rate was 4.01% during that month, and the interest rate on our duplex was 4.38%. Talk to a lender so that they can give you an idea of what your interest rate will be when buying an investment property.

Gross Monthly Rent: This is the amount of money you plan on making per month for your rentals. You can use tools like Rentometer.com and Craigslist to get an idea of what similar properties in your area are renting for.

Utilities (Water/Sewer, Electricity, Fuel, Garbage): Most multi-family properties have separate electrical meters, so the tenants will pay for this themselves. For single family or duplex rentals, tenants also typically pay for their own garbage pickups. You can call your local utility to get an estimate for water/sewer costs and fuel costs. The property analyzed above has a cistern and septic tank, so there won’t be any additional costs needed for water/sewer.

Property Taxes: The property tax info is usually shown on the listing. You’ll want to include this expense in your analysis because it’s added to your monthly mortgage payment.

Monthly Insurance: To get an estimate on monthly home insurance, you can call insurance companies and give them the information on the property you’re looking at. This expense is also included in your mortgage payment.

Vacancy Rate: If you don’t know what the vacancy rate is in your area you can talk to property management companies or other landlords in your area to get a better idea. The area that I’m looking at has a pretty good vacancy rate at 2%. The value entered in the spreadsheet subtracts the vacancy rate from the overall rental income.

Maintenance: A good rule of thumb is to use 5% of the monthly rent for maintenance expenses. Over the past two years, the maintenance costs for our duplex have been about 4% of the monthly rent per month.

Capital Expenditures: Capital expenditure are big ticket items that need to be replaced every so often like a roof, a furnace, or a water heater. Setting aside 10% of the monthly rental income is generally used amongst real estate investors for approximating these costs.

Amount Needed at Closing: This total includes the down payment, repairs, and closing costs.

Monthly Cashflow: Here is where we see if the property will be making money every month. This is the monthly income from rent minus the expenses. Below is the cost break down for our example:

$2,400 in monthly rent – $994 (mortgage) – $187 (property tax) – $82 (insurance) – $100 (fuel) – $48 (vacancy) – $120 (maintenance) – $240 (capital expenditures) = $629 income per month.

Rate of Return on Investment: This number is the “tell-all.” It’s how I know whether or not I want to invest in this property. The monthly cash flow told us that we’d make $629 per month. That may sound like a lot, but without context we have no idea if we’re making a suitable return on our initial investment. The initial investment made is the “Amount Needed at Closing.” For this example, $80,000 will be needed at closing. The rate of return on investment is the yearly estimated income from the property divided by the initial investment: $629 per month x 12 months = $7,548/$80,000 = 9.4%.

Personally, for me, I’m looking for a rate of return that is at least 8%. If I’m not getting an 8% rate of return, then my money is better off invested in index mutual funds where I will get an 8% rate of return.

The property analyzed above is actually listed for $280,000. At that price point the rate of return is only 6.2%. This property has been sitting on the market for over a year and it needs $20,000 worth of work, so we plan on offering $240,000 and asking the seller to cover the closing costs. The the seller will most likely counter offer and we’ll have to compromise. I’ll let you know if the offer gets accepted in future posts!

If you’re interested in learning more about investing in rental property, I highly recommend Brandon Turner’s book “The Book on Rental Property Investing”. This book opened my eyes to the possibilities of investing in rental properties, and gave me practical knowledge that got me successfully through my first purchase.