Recently, I was listening to a Financial Freedom podcast on tax optimization where Grant Sabatier interviews Justin from rootofgood.com. After listening, I was inspired to take a look at my own tax situation, and I realized I was making a huge financial mistake. What I’m about to share could save you $10,000 or more per year in taxes. So what is the best way to save money on your taxes? Take full advantage of tax deferred investment accounts.

In 2015 I started a taxable investment account as part of my plan to retire before 59 ½ – the magic age when you can withdraw money, penalty free, from your 401k and IRAs (Individual Retirement Account). If you withdraw funds from these accounts before 59 ½ you’re hit with a 10% penalty. Ouch!

In order to have penalty free money available to me before 59 ½, I started a non-retirement investment account. At the time, I thought I was being smart – avoiding the penalties, but I was so wrong. Let me explain…

Example of Not Taking Full Advantage of Tax Benefits

My original investment strategy was to invest up to my employer’s match in my 401k (4% of my salary) while also investing between 40%-50% of my salary into a taxable investment account.

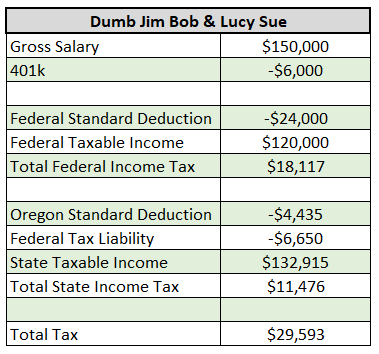

For example, a married couple, Jim Bob and Lucy Sue each make $75k per year (150k per year total) and live in Oregon. They have a goal to save $50k per year for their retirement. They each contribute up to their employer’s match into their 401k (4% each, $6,000 total) and invest the rest of their money in a taxable investment account ($44,000).

Let’s look at the tax implications of this strategy, starting with federal taxes (bear with me on this). In 2018, the federal standard deduction was $24k for a couple. 401k contributions will reduce taxable income. So, Jim Bob and Lucy Sue’s taxable income is $120,000 and they pay a total of $18,117 in federal income tax.

Now let’s look at state income tax. Oregon’s standard deduction is $4,435, a maximum of $6,650 is subtracted from your taxable income based on how much federal tax you pay, and 401k contributions still reduce your taxable income. After all that nonsense, Jim Bob and Lucy Sue pay $11,476 to the state of Oregon, and total of $29,593 in taxes.

Example of Taking Full Advantage of Tax Benefits

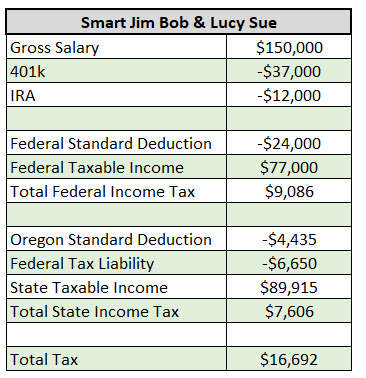

Now, let’s look at how much money Jim Bob and Lucy Sue would have saved if they took full advantage of tax deferred retirement accounts. The maximum contribution limit for a 401k in 2018, was $18,500. Jim Bob and Lucy Sue each max out their 401k ($37,000). They also open IRA accounts and contribute the maximum amount towards these ($12,000). Just like 401k accounts, money contributed to an IRA is tax deferred. Take a look at the table below to see how much money they would have saved with this new strategy.

After maxing out their 401k and IRAs they now only pay $16,692 in taxes. That’s a difference of $12,901! That’s extra money they could have further invested in a taxable investment account, or money they could have used for a house remodel, or on a luxurious vacation.

Accessing 401k and IRA Money Before 59 ½

You may think this is all well and dandy, but what about accessing this money before 59 ½? The money you withdraw from a 401k or IRA before 59 ½ will be hit with a penalty of 10%. On top of that, you will also pay tax when you withdraw this money.

One way to game the system is by rolling over the money in your 401k accounts into an IRA. Once your 401k money is in an IRA, you can take Substantially Equal Periodic Payments (SEPP) penalty free before the age of 59 ½. When using a SEPP you must make annual distributions for five years or until the age 59 ½ (whichever comes later). Another way you can access this money is by creating a Roth IRA conversion ladder. I’ll talk about this more in a later post, but for now just know that accessing this money penalty free is possible. So, thank you, IRS and your goofy rules and loopholes!

Taxes During Retirement

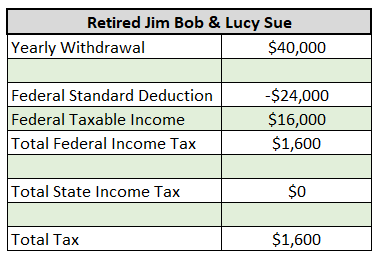

Once you withdraw your IRA money you will be taxed on it. However, you are likely to be in a much lower tax bracket during your retirement years. In the example above, Jim Bob and Lucy Sue plan on living off of $40k per year. Meaning, they’ll be withdrawing $40k per year from their IRA account. To further take advantage of taxes, they plan on living in a state with no income tax. Given the tax codes the way they are today, they will only end up paying $1,600 per year in federal income tax during their retirement years (see below).

Even if the IRS got rid of their loopholes you would still be better off investing in your 401k and IRA’s with the 10% early withdrawal penalty. In this example, the penalty you would receive would be $4,000. Compare that to your taxes saved above of almost $13,000 and you’re still saving yourself thousands of dollars every year.

Taxes in a Taxable Investment Account

If you instead go the route of keeping your money in a taxable investment account, not only will you be paying more in income tax every year, you’ll also be paying tax each year for the capital gains and dividends you receive. Depending on the mutual funds you select, you could be paying additional tax on 4%-5% of your account balance each year. If you instead put your money in an IRA or 401k, that sweet stash grows tax free until you withdraw it.

Wrapping it All Up

Hopefully this post will help others avoid the same mistake I made these past 4 years. I might have shaved off years from my retirement date, if I would have known otherwise. Don’t be like me! Take advantage of 401k and IRA accounts which are tax sheltered until you withdraw the money during your retirement years. As I’ve shown above, it can save you $10,000 or more per year.

Read more about my fail safe plan to retirement here. As always, if you have any questions, feel free to reach out to me.