You will always need a place to live. You can either increase someone else’s net worth in the form of rent or increase your own net worth in the form of a mortgage. There are many arguments out there for renting versus buying. Some people say they’ll never buy a house because of the the hassle and upkeep as a homeowner. Or they’re afraid of a market downturn. But later on, I’ll show that buying a home almost always makes more financial sense over the long run.

The number of people who choose to rent versus buy are on the rise. But, even in high priced markets, like where I live in Portland, the numbers speak for themselves.

To prove my point, I checked out Craigslist in my area. A decent 3 bedroom 1,500 square foot, single family house in a Portland suburb costs $2,140 per month to rent.

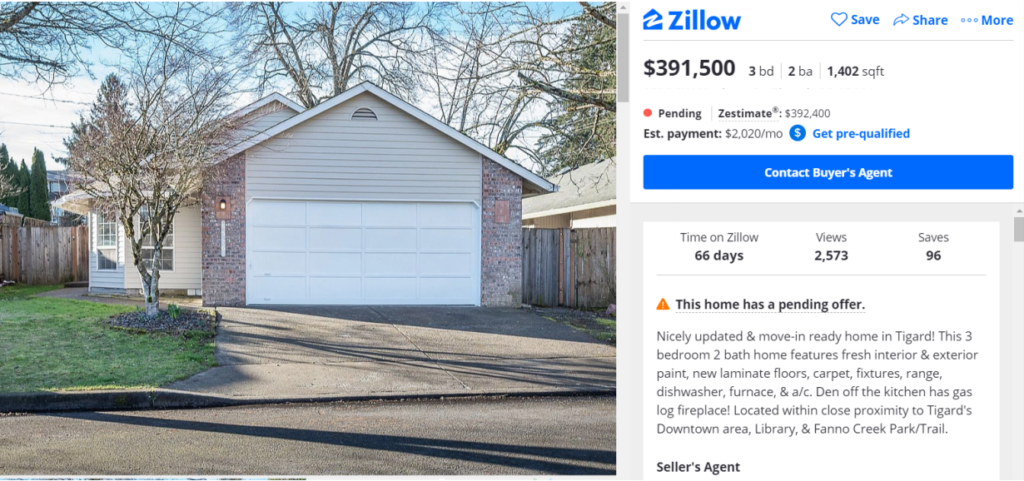

I then found a house on Zillow in a nearby neighborhood for sale for $391,500.

Let’s Break Down the Cost Difference:

The cost breakdown of the rental is easy, it will cost $2,140 per month.

The monthly cost of buying the $391,500 house will depend on a few things:

- The Down Payment – You can typically buy a house for as little as 5% down – about $20,000 for this house. Private mortgage insurance (PMI) is required when putting down less than 20% – which comes to about $115 per month in this case.

- The Property taxes – The property tax for this house is $4,000 per year, or $333 per month.

- The Mortgage – A mortgage of $370,000, with a fixed 4.25% interest rate, over 30 years will cost $1,820 a month.

This totals out to a payment of $2,330 per month, $190 more than the rental. You might be saying, “AHA! Renting is better than buying, I told you so!”

Woah there, bucko, slow your roll. Let’s check out the long term first:

As a renter how many times has your rent increased when your lease gets renewed? If you’re lucky, the answer is never. But you’re at the mercy of your landlord. Typical rents increase 3% per year, so in 30 years your $2,140 per month rent could be $5,043 per month (ouch!).

Over the course of 30 years you will have paid $1.2 million dollars in rent. And; to add insult to injury, over the span of that time, you’ve added nothing to your net worth.

On the other side of things, your mortgage payment will stay fixed over the next 30 years. The $2,330 monthly mortgage payment will stay $2,330 for 30 years.

Doing the Full Comparison:

Buying a house does require home maintenance. I estimated $200 per month for this example (this is a conservative estimate based on my experience of owning a home the last 5 years).

Over the course of 30 years at $2,530 a month ($2,330 monthly payment + $200 for maintenance expenses), you will spend $911,000 for your house.

And after 30 years, the mortgage will be paid off, leaving only the costs of property taxes and insurance ($400 a month). Assuming the property hasn’t appreciated (very unlikely), after 30 years your house has also added $391,500 to your net worth.

Just to clarify where we’re at after 30 years: You’ve paid less money overall, and your net worth is more.

If we carry this out over 60 years, the difference becomes even more drastic. The renter will have paid $4.2 million dollars versus $1.1 million dollars for the home owner. That’s a difference $3.1 million dollars.

Still think renting is better?

If you’re the kind of person that doesn’t want to settle down and plans on moving every couple years, then you should definitely rent. However, this kind of lifestyle doesn’t make much financial sense and will definitely set you back on your path to financial freedom (excluding you van lifers out there). 90% of the world’s millionaires got there by using real estate.

Based on the example above, over the course of 60 years you could be saving yourself $3.1 million dollars. I encourage you to look at the cost differences in your area and find out how much you could be saving over your lifetime. Also, check out this post to find some Unique Ways to Save on Housing.

Stop paying someone else’s mortgage with your monthly rent and invest the money in yourself. It’s clearly worth it in the long run.

See how we’re using real estate to reach financial independence and retire early.