Healthcare coverage is easily overlooked when planning early retirement. Our coverage is usually, well, covered by the company we work for (at the cost of a chunk of our paychecks.) But, we’ll lose that coverage after quitting those jobs to retire early. So, how do we afford to cover our own healthcare for the rest of our lives? Introducing… the HSA.

What is a Health Savings Account?

Health Savings Accounts (HSA) have become popular in recent years to keep up with rising costs of healthcare. An HSA is an account that you contribute funds to which can be used to cover medical expenses now and in the future (retirement years). It’s often included with the high deductible healthcare plan (HDHP) offered by your employer.

I first signed up for an HSA in 2014 after starting a new job. Looking at my health insurance paperwork, and – not understanding any of it – I chose the HDHP plan. The monthly costs (premiums) were significantly less, and that was a good enough reason for me to choose it. I didn’t actually understand how an HSA worked until almost year later.

I wish I had known about HSA’s sooner. The earlier you start contributing; the beefier your HSA will be at retirement. You want that money invested and growing for as long as possible.

How to Get an HSA

In order to qualify for an HSA, you must be enrolled in a HDHP. A HDHP has a minimum deductible (amount you have to pay before insurance fully kicks in) of $1,300 for an individual. If you’re on an HDHP but your healthcare provider doesn’t offer an HSA, then you can open your own HSA at most financial institutions (ex. Fidelity.)

The advantage of an HSA account is that it a triple tax benefit:

The 1st tax benefit – The money that you contribute to your HSA is tax free. Typically, when choosing your health insurance, you specify how much of your paycheck goes to your HSA. Note that the maximum amount you can contribute to an HSA as of 2019 for an individual is $3,500 per year. It’s best to max out your HSA contribution every year if possible.

The 2nd tax benefit – The interest and investment earnings you make in your HSA grow tax free. Most financial institutions will allow you to invest your HSA money in mutual funds. When setting up your HSA, make sure your financial institution allows you to invest your HSA. I recommend investing your funds in an S&P 500 index mutual fund.

The 3rd tax benefit – Payments on medical expenses are tax free.

To recap, the money you put into your HSA is tax free, the earnings you make from investments are tax free, and when you pull the money out to pay for medical expenses you don’t get taxed. It’s like living in a future utopian paradise where you actually get to keep all the money you’ve earned. It doesn’t get much better than that. This is how I intend to pay for healthcare during my retirement years.

Will it Be Enough?

Let’s look at an example of a couple that starts their careers at 22. They both sign up for an HDHP plan through their employer and set up an HSA account. Each year they max out their HSA contributions ($7,000), and they invest the money in mutual funds. They are both relatively healthy and spend less than $1,000 per year from their HSA’s on medical expenses. So, we’ll say $6,000 is invested each year, growing at a rate of 8% per year (stock market average after inflation) until they decide to retire early at 40. When they retire, their HSA accounts have grown to a value of $242,000!

In my three tier retirement plan post, I talked about the safe withdrawal rate (SFR). An SFR is the amount of money you can safely withdraw from an account without ever losing money. If you keep your HSA funds invested in mutual funds, a conservative safe withdrawal rate is 4%. So you can safely spend 4% of $242,000 every year ($9,680) for medical expenses and never run out of money in your HSA.

Will it Be Enough?

Of course an HSA alone will not be enough to cover all of your medical expenses during the golden years. So, now let’s look at how much health insurance costs. Healthcare.gov compares health insurance plans for you. Premium tax credits are given based on your expected yearly income.

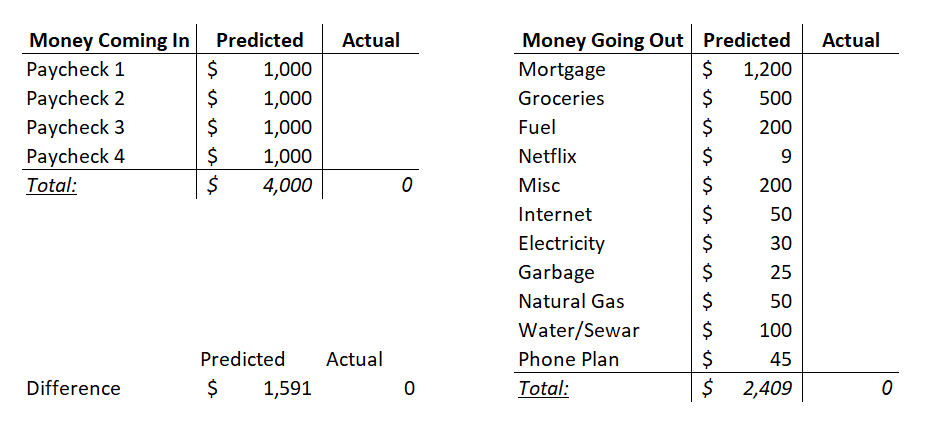

Looking at the sample budget below, this couple will need around $29,000 per year in income ($2,409 per month times 12 months) to get by. Let’s round that number up to $40,000 for additional retirement fun.

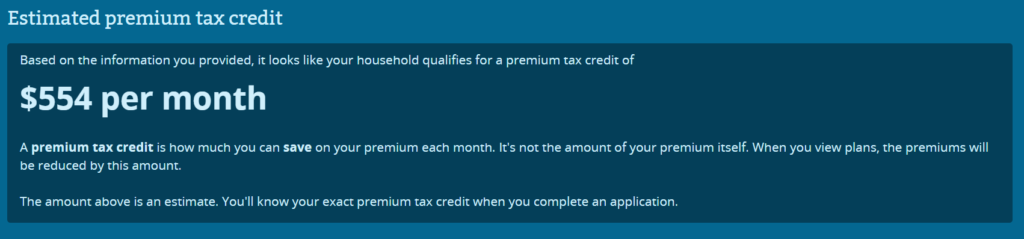

A yearly income for a couple of $40,000 qualifies for a tax credit of $554 per month.

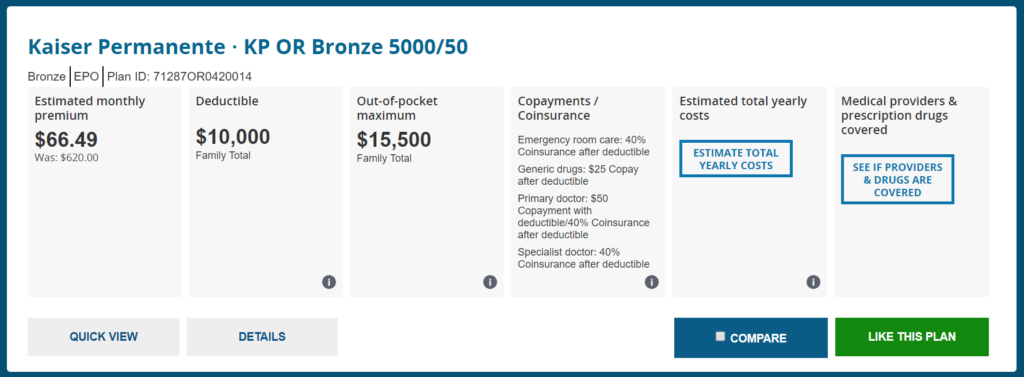

Based on our safe withdrawal rate of $9,680 per year from the HSA, we can look for a health care plan with a deductible of $10,000 per year. The one shown below has a monthly premium of $66.49 after applying the $554 a month tax credit.

In the plan above, after the $10,000 deductible is met (which you can pay using the funds from your HSA), insurance will cover 40% of your healthcare costs until you pay a $15,500 (maximum out-of-pocket), at which point insurance will cover 100% of your costs.

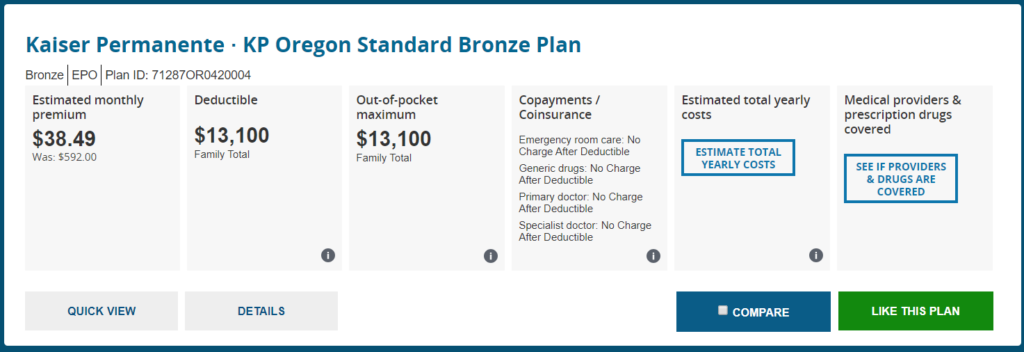

Another option is shown below. This plan has a higher deductible, but once the deductible is met, insurance covers 100% of your healthcare costs. The plan also has a lower monthly premium at $38.49 per month. Even though the $13,100 deductible is above the calculated safe withdrawal rate of $9,680, this plan has a much lower premium. Personally, I’m more inclined to go with this option.

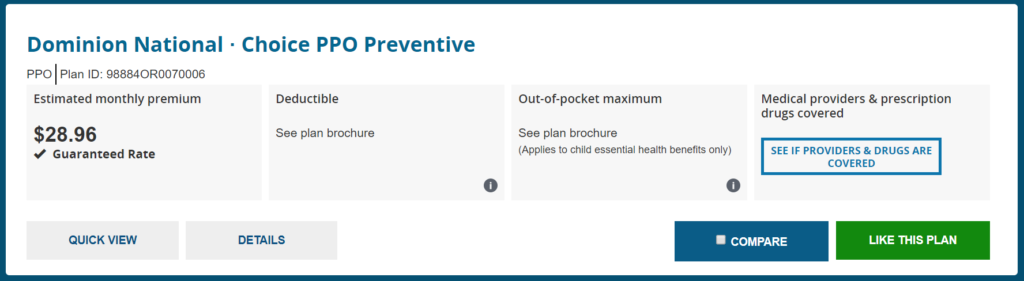

On the healthcare.gov site, you can also add dental insurance for $28.96 a month.

Protect Your Retirement

By investing the maximum contribution into your HSA over the years, you can get healthcare coverage during retirement for less than $100 per month. That $100 per month is something you’ll need to consider when estimating your expenses during retirement years, but is not something that will break the bank or prevent you from reaching your goals of early retirement.

If you don’t plan ahead, a few unhealthy years could force you out of early retirement. No one stays healthy forever. A hefty HSA with a modest insurance plan could mean the difference between living out those retirement years, and going back to a 9 to 5 job to make ends meet. Don’t let poor planning ruin your retirement and don’t underestimate the power of an HSA.