Making your 401k selections can be a stressful endeavor. Your 401k will be one of your greatest tools for building wealth and allowing yourself to retire early. But how should you invest your 401k? In this post, I’ll share three straight forward strategies for investing your 401k that consistently outperform professionally managed portfolios. Learn how to become a master of your 401k!

I remember my first time choosing my 401k investments. I had just graduated from college and started my first real world job. I was really confused by all of the options. It’s taken me a while, but after many years of mistakes, research, and experiments, I feel like I’ve this whole 401k thing pretty well nailed down.

So fear not, I’m here to guide you through the process. Maybe, you’re like most people and have never actually looked at your 401k elections and just kept the “default” setup. In this post I’ll go over three portfolio strategies, and at the end I’ll show you the performance of all three, so you can choose which option is best for you. When we’re done you’ll be able to set up your 401k elections so it’s a money-making machine in no time.

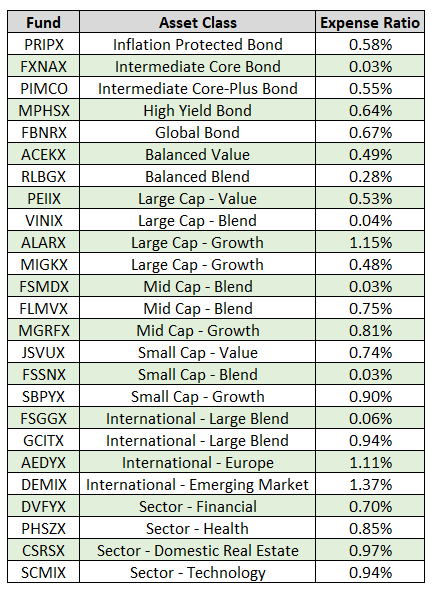

The table below shows a list of the different options from my personal 401k account:

Yikes. At first glance, this can look like a whole mess of nonsense. Simply put, the investment options are mutual funds comprised of stocks and bonds. But beyond that, how do we understand this stuff to optimize our investments?

Portfolio 1: Keep it Simple, Stupid

The simplest and arguably the best approach for picking your 401k allocations is to just pick one mutual fund and put all your investments into that one fund.

I can hear the people screaming from the rooftops now. “What about diversification? You should never put all of your eggs in one basket!” Don’t worry, I’m getting to that.

The one fund you pick should be an S&P500 index mutual fund. You may have heard of the S&P500. It’s a collection of the 500 largest companies in the United States. An S&P500 index mutual fund simply tracks the S&P500, which has averaged 8% yearly returns since its inception. Every 401k plan I’ve been a part of has had an S&P500 index fund. Yours should too. When you select this fund, you are diversifying your money amongst the 500 largest companies in the United States. Now that’s some sweet diversification!

But why pick an S&P500 index fund instead of any of the other funds available? Because, the S&P500 outperforms 92% of actively managed funds (an actively managed fund is any mutual fund that isn’t an index fund). So choose an S&P500 index fund!

Still don’t believe me about index funds? Check out the Warren Buffett challenge, and I’m sure you’ll change your mind.

Ahhh, good ol’ Warren Buffet. Solid advice.

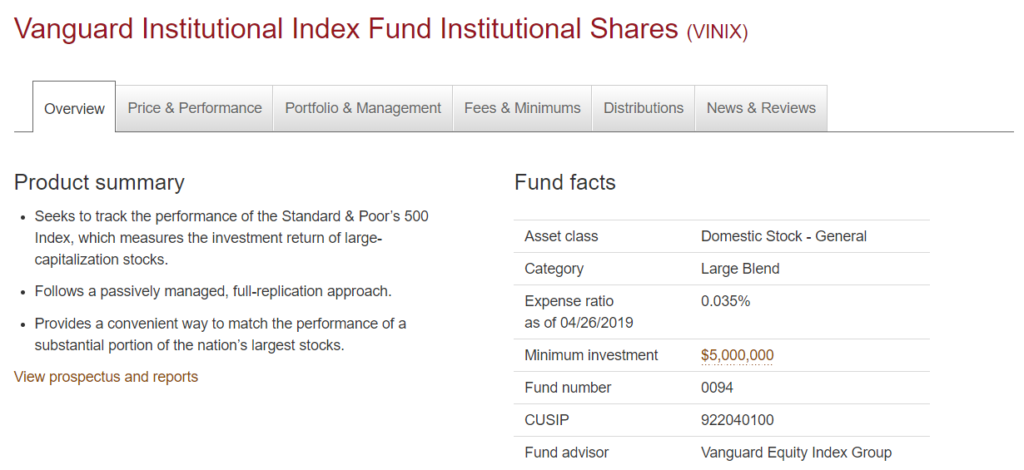

Following this method, I would choose VINIX. See the snapshot below from Vanguard which gives an overview of the fund. Note how the summary states that it tracks the S&P500. Also notice how the expense ratio is only 0.035%. Index funds usually stick out like a sore thumb because their expense ratios are significantly less than those of actively managed funds. Take a look back at the table at the beginning, and I’ll bet you’ll be able to pick out the index funds from the actively managed funds.

Portfolio 2: Easy Asset Allocation

You can remove some of the gut-wrenching volatility of investing in only the S&P500 by diversifying yourself with bonds. The idea behind diversifying with bonds is that stocks and bonds are usually uncorrelated. In other words, if the stock market crashes, bonds will be unaffected. By diversifying with bonds, you smooth out the wild ride of the stock market, while still maximizing returns over the long run. Vanguard’s founder Jack Bogle recommends the following asset allocation:

- S&P500 Index Fund (65%)

- U.S. Intermediate Bond Index Fund (35%)

Let’s look at an example of how this asset allocation could be useful. Below is a comparison of the S&P500 and U.S Intermediate Bonds in 2008:

The S&P500 (VINIX) saw a decrease of 35.58%, while U.S. Intermediate Bonds (VBIIX) only saw a decrease of 0.85%. If you can’t stomach the thought of losing 35.58% of your retirement savings in one year, you will probably want to diversify yourself with bonds. Based on the options I have available to me, I’d set my allocations to 65% VINIX and 35% FXNAX or “Fidelity U.S. Bond Index Fund”.

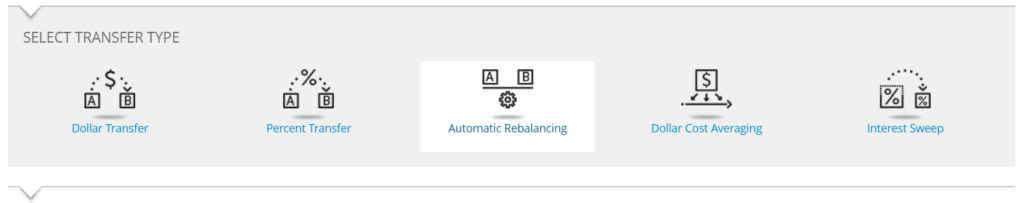

When investing in more than one mutual fund, you’ll want to make sure your account is automatically rebalanced. There should be an option for this while making your elections. This option will periodically rebalance your 401k automatically, so you’ll always have a 65/35 allocation between stocks and bonds. The idea behind this is to buy low/sell high. If your stock allocation gets to 70% and your bonds are at 30%, you’ll want to sell a portion of your stocks (sell high) and replace that portion with bonds (buy low).

Portfolio 3: A Bit More Asset Allocation

You can potentially gain better returns over the long run by further diversifying your stock holdings. Instead of just investing in the S&P500, you can further diversify your stocks by investing in small companies in the US. Small sized companies are more volatile than those in the S&P500 but can offer greater returns. You can also further diversify your stock holdings by investing in international companies throughout the world. This asset allocation would look like this:

- S&P 500 Index Fund (25%)

- Small Cap Index Fund (25%)

- International Index Fund (25%)

- U.S. Intermediate Term Bond Index Fund (25%)

For my account, I’d set my allocations to 25% VINIX, 25% FSSNX, 25% FSGGX, 25% FXNAX. Don’t forget, I should set my account up for automatic rebalancing too.

Portfolio Comparison

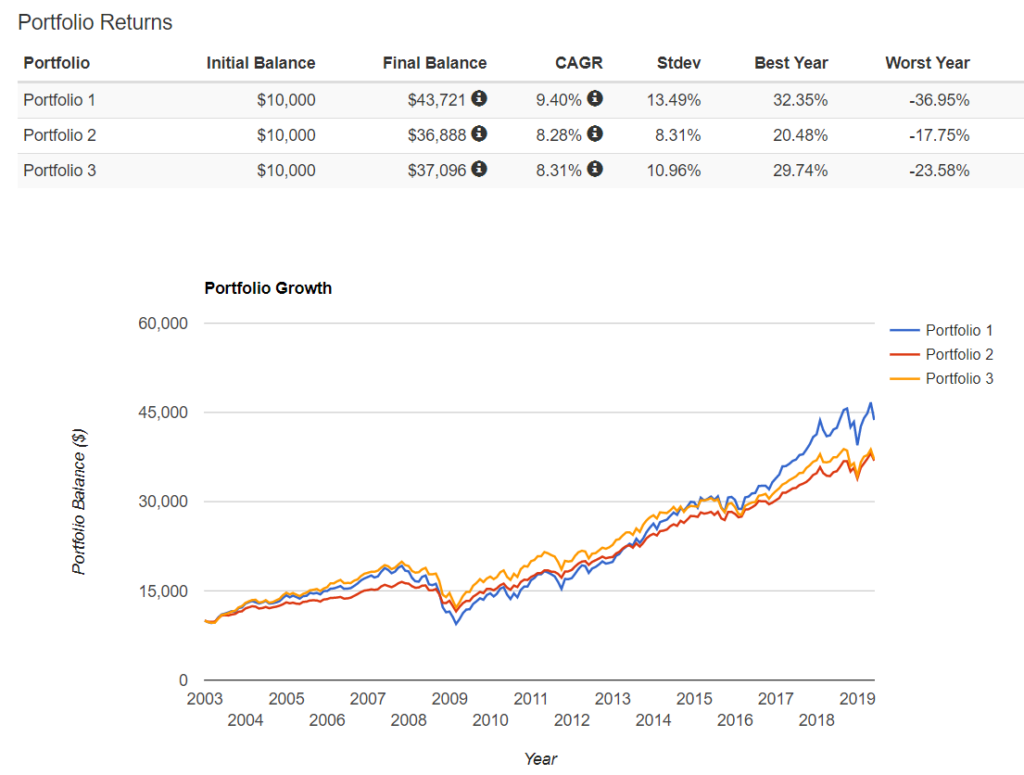

Using the site https://www.portfoliovisualizer.com I compared the three portfolios above to see how they measure up over the last 15 years. Seen below are the three portfolios from 2003 to 2019, considering an initial investment of $10,000. Note, some of the funds were replaced with comparable funds since they haven’t been around long enough to analyze back to 2003.

The CAGR in the figure above is the annual rate of return. All three cases have a rate of return greater than 8%. Not bad considering this time period was during the great recession. Portfolio 1 has performed best over the last 15 years but has also been the most volatile (worst year -36.96%). Portfolio 2 has performed the worst but has been the least volatile (worst year -17.75%).

Something else to consider is dividends. These returns don’t account for the dividends you’d receive from the stocks of your portfolio. For the funds we’ve selected above these dividends range from 1%-2.5% per year. 401k accounts are set up to automatically reinvest these dividends into your account.

Consider the S&P500 fund we chose (VINIX). It provides a yearly dividend of 2.12%. This doesn’t sound like much but compounded over time the results are extraordinary. VINIX (Portfolio 1) has had an annual rate of return of 9.4% over the last 15 years. After 30 years, your initial $10,000 investment will have grown to $363,000. Not bad, right? Now let’s consider reinvesting your dividends every year. Your annual rate of return is now 11.52% (9.4% + 2.12%). After 30 years, your initial $10,000 investment will be $783,000. More than double your returns without dividends. That’s the power of compounding interest!

Choosing Your Portfolio

Each of the portfolio’s I’ve presented above have their advantages and disadvantages. You’ll have to make the decision for yourself. I’ve been using Portfolio 3 for the past few years, but that’s just me. The important thing to do is actually set up your 401k account and make your elections that stray away from the account defaults which have lousy returns. Hopefully this article has simplified how to make your 401k elections, so you can start your journey towards financial freedom! If you have any questions, feel free to reach out to me. If you want to learn more about my plan to early retirement, check it out here.