I’ve made plenty of mistakes on my path to financial independence. Part of the reason why I wanted to start Nine to Thrive was to teach others not to make the same mistakes that I’ve made.

Although I don’t have any regrets, I could have shaved years off my path to financial independence if I would have avoided making these four mistakes.

Let’s dive in!

#1: Choosing the Wrong Major

In 2006 I followed my passion and entered my first year of college as a music education major. I had hopes of becoming a high school music teacher. In my second year in the program, I was tasked with job shadowing local music teachers.

After a semester of job shadowing, I was able to see first hand the every day struggle of music teachers. Funding was being reduced, programs were being cut, and teachers were traveling to multiple schools daily just to maintain full time work.

After seeing this, I sat down and reconsidered my options. I already knew that a teaching salary was modest at best. But if I wanted to provide for a family some day, how was I ever going to be able to do that if it was going to be a struggle just to maintain a full time job?

Making the Change

So I made the change. That summer I informed my instructors that I’d be changing my major from music education to electrical engineering. Only one of the classes I had taken in my first two years was transferable to an electrical engineering degree. I was basically starting from scratch.

A lot of people ask why I picked electrical engineering. In high school I wasn’t particularly good at math. I got D’s in math my sophomore and junior years, and didn’t even take a math class my senior year.

When I was looking for a new degree to pursue, I Googled “hardest college major” and electrical engineering showed up. I never had any interest in engineering (don’t say that in a job interview), and like I previously mentioned, I was never that great at math. But I found that electrical engineers had decent average salaries, and I always enjoyed a good challenge, so electrical engineering it was!

Following Your Passion is Overrated

People change. Your passion today could very well change in the future. And not all passions translate to a prosperous career.

Following your passion doesn’t mean a happy working career either. The culture of the company you work for has more to do with your job happiness than anything else. I went from hating my career to loving my career just by making a job change.

I’m not suggesting you give up on your passion. I still enjoy making music almost daily and am able to teach in the form of this blog. And when you reach financial independence in your 30’s or 40’s, you’ll have all the time in the world to pursue your passions.

So enter mistake one. I should have picked electrical engineering from the get go. I unnecessarily paid for two extra years of college. And on top of that, I lost two income earning years that could have been spent investing towards my financial freedom. Luckily, I was still able to get through college debt free.

#2 Using a Financial Advisor

In 2011, during my final year of college, I started an investment account at Edward Jones. This was mistake number two.

I had never invested before, and had no clue what I was doing. So, I reached out to a family friend who just so happened to be a financial advisor at Edward Jones.

But the problem with Edward Jones is that the financial advisors are trying to balance the needs of their clients with making a commission for themselves.

A fee will be associated with every transaction you make when you use a financial advisor. And studies show that your probability of beating the market are slim to none (even with the “expert” advise from a financial advisor).

I should have started investing with Vanguard and ditched the financial advisor. Vanguard offers index mutual funds with some of the lowest expense ratios in the game. It wasn’t until this year (after almost 8 years of investing) that I switched all of my retirement accounts over to Vanguard.

The great thing about Vanguard is that it’s owned by its customers and operates at cost. Meaning any profits that Vanguard makes gets redirected back into their mutual funds. No other investment firm is operated this way, so they will always have an edge over their competition.

Avoid the same mistake that I made, and use Vanguard for you investment accounts from the get go.

Read my full review of my experience of Edward Jones versus Vanguard here.

#3 Low Savings Rate

We don’t really have much say when it comes to our salaries. However, we do have a say when it comes to our spending.

A person that makes $50,000 per year that’s able to save $5,000 (10% savings rate), will be able to retire sooner than a millionaire who spends all their money every year.

How many times have you heard of a financial collapse from somebody famous? Mike Tyson earned over $300 million dollars over his boxing career, but later ended up filing for bankruptcy.

I didn’t lose $300 million dollars but I haven’t been great about my savings rate. Enter mistake number three.

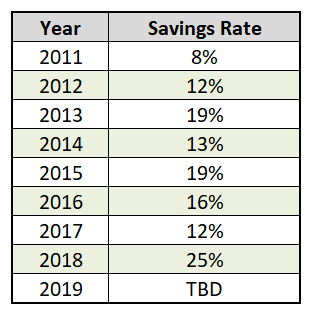

In previous posts I’ve mentioned that a savings rate of 40%-50% is a good goal to strive for. However, my own savings rate since the onset of my working career has been less than stellar. Below is a table showing my savings rate each year since I’ve started working. I’m almost ashamed to show this…

Yeah I know, it’s pretty bad. BUT there is hope! So far this year, Mrs. Nine to Thrive and I are on track to have a savings rate of 40%. And next year our goal is to have a savings rate of at least 50%.

In my fail safe retirement plan I go into the background of how long it will take to reach financial independence based on your savings rate. But spoiler alert, with a 50% savings rate, you can expect to reach financial independence in about 15 years.

Another spoiler alert, if you check out that post you can see a picture of me with long hair (ahhh the good ol days).

#4 Not Taking Advantage of Tax Deferred Accounts

And finally my last mistake. Which is…not taking full advantage of tax deferred retirement accounts until this year.

Retirement accounts like 401k’s, 403b’s, 457s, and IRAs are meant to be used during retirement years. So if you want to pull money from these accounts before the age of 59 1/2, you can expect to pay a 10% penalty. Or so I thought…

Because I had dreams of retiring before 59 1/2, I said forget that retirement account nonsense. I’m going to need my money sooner. So, up until this year I put the majority of my investments into a taxable investment account.

What I later found out is, there are loopholes in the system for ways you can actually access your retirement account money before 59 1/2 penalty free! One of those ways is called a Roth IRA conversion ladder. I won’t get into all the gory details here, but the point is, there are ways to access this money without being dinged with a 10% penalty.

By not taking advantage of tax deferred retirement accounts, I paid an additional $9,000 in federal income tax just last year!

That’s not happening again, this year I’m taking full advantage of retirement accounts, and plan to continue that trend until I’m able to reach financial independence.

Related: The Best Way to Save Money On Your Taxes

Avoid My Mistakes!

So there you have it. Those are the four biggest mistakes I’ve made on my path to financial independence.

It’s hard not to wonder how much further along I’d be on my path to financial independence if I could have avoided these mistakes.

Not only would I have been able to start investing two years earlier, but if I would have avoided a financial advisor, increased my savings rate, and taken advantage of tax deferred retirement accounts, I’d probably be close to financial independence already.

As it stands, my goal is to work for another nine years and retire by 40. But hey, retiring at 40 ain’t so bad.