The statistics these days say that as many as 45 million Americans have student loan debt totaling close to $1.5 trillion dollars. Today, taking out student loans is considered normal, everybody’s doing it. To make matters worse, I’ve heard stories of high school guidance counselors persuading students to go to private universities over in-state public universities. Why!? This is asinine advice.

I have a co-worker that went to a private university. The tuition and fees and for this private school are over $45,000 per year Over the course of four years, this co-worker accumulated over $150,000 worth of student loan debt. He wants to buy a house and start a family but is being crippled by his exorbitant amount of loans.

I went to an in-state public school in Alaska (UAF). The tuition and fees at UAF are $8,500 per year. I put myself through college without taking out any student loans and graduated debt free. This would be impossible if I had chosen a private university. Read a more about how I was able to get through college debt free here.

Fast forward to our working years. We both have the same degree, work at the same company, and do the same job. So why choose an expensive private school when it will provide you absolutely no benefit during your career?

Don’t be part of this statistic. There are so many ways you can avoid taking out student loans. In this post I’ll give you 3 hacks to avoid or reduce student loan debt, so you won’t become one of those 45 million Americans struggling with debt.

1. Get a Job that Pays for Your Degree

There are many employers that will cover the costs of tuition if you are employed with them at least part time. Starbucks is one of them. If you are working at least 20 hours per week, Starbucks will pay for all of your tuition to earn your bachelor’s degree through Arizona State’s online program. That is a pretty sweet deal! But it doesn’t end with Starbucks. Companies like AT&T, Bank of America, Chipotle, and even more offer tuition reimbursement. Speaking of Chipotle, now I’m hungry for a burrito, be right back.

Ok back.

Every engineering company I’ve worked for has offered to cover 50%-75% of tuition costs for their employees. An added benefit to this is once you have your degree you can move into an engineering role at the company.

In my previous job, I had a co-worker who was a drafter. He wanted to go back to school to get his engineering degree. The company covered the majority of his costs for tuition and was flexible with his schedule. The guy was a Rockstar, working full time, going to school, and raising two kids to boot. Last month he graduated with his engineering degree and didn’t have a dime in student loan debt. Now that’s the kind of hacking I’m talking about.

2. Cut Your Housing Expenses

After tuition, your next largest expense will be the cost for housing. Avoid living on campus if at all possible! You’ll be stuck overpaying for a small jail cell type dorm room and forced into buying an expensive meal plan. The average cost for a dorm at a university is $6,000 per year (and this doesn’t even give you a place to live during the summer). You can easily cut this cost in half.

Enter roommates. Being in your late teens and early twenties is the time in your life when it’s not weird to have roommates. I had a group of four friends that rented a house together during college. Their $1,500 per month rent was split evenly so each person was only paying $375 per month. During the school year (9 months) each person only paid a total of $3,375 for housing. Just four dudes, living in a house together, going to college, totally normal. Tell people you live with three other guys while you’re in your thirties and you’ll probably see some raised eyebrows in reaction. But, hey, if it helps you save money and your willing to do it, I say go for it!

If you’re going to a local university and can stomach the thought of continuing to live with your parents while going to college, you can cut your living expenses to zero! I lived at home during my first year of college and it significantly reduced my overall expenses.

3. Cut Your Food Expenses

When you live on campus you’ll likely be forced to buy an expensive meal plan. The cost of your meal plan is often equivalent to the cost of your dorm room. What!? Who pays the same on their food as they do on their housing costs? That’s insane! The average cost of room and board at a university is $12,000 per year. At $6,000 per year for the cost of a dorm room, that means you’re paying $6,000 for meals. No, no, no. This is robbery.

You can get by on $50 per week on groceries. Multiply that out by 9 months and it comes out to $1,800 for the entire school year. One of my favorite cheap dinners during college (and still is actually), was chicken and potatoes. You can buy a whole chicken for around $6 and a couple of potatoes for $1. Bake the whole chicken in the oven and eat with mashed potatoes. The chicken and potatoes are enough to last for two meals. You can use the leftovers from the whole chicken, combine it with carrots, celery, and some noodles ($4) in a slow cooker and you have a delicious chicken noodle soup. Good for another two meals. So, for $11 you’ve just provided yourself with four dinners for the week.

My wife and I enjoy using the site https://www.budgetbytes.com/. The meals are budget conscious, easy to make, and delicious. Some of our personal favorites are ‘Weeknight Black Bean Chili’ ($1.20 per serving), ‘Thai Curry Vegetable Soup’ ($1.53 per serving), and ‘BBQ Chicken Burrito Bowls’ ($1.78 per serving). If you’re able to spend between $2-$3 per meal, you’ll be able to keep your grocery bill to $50 per week.

Total Cost Savings

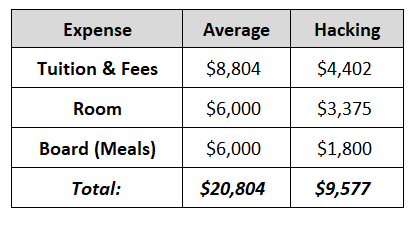

Applying these costs savings hacks during college will reduce your expenses by more than half of what the average student pays. Check out the table below to see for yourself (averages from NCES). For tuition and fees, I assumed you’d use Hack #1 with your employer covering at least half of your overall expenses.

Multiply these savings by four years of college, and you’ll be saving yourself almost $45,000! That’s money you may have otherwise needed student loans to pay for. If you’re a student, use these hacks to your advantage. If you’re a parent, share these hacks with your children. We, as a society, can’t keep adding to the $1.5 trillion dollar debt and expect a bail out from somebody else.

When you don’t have to spend years after college paying off student loans, you can get a head start on a path towards financial independence. Think ahead, it will be nice to have a good job making good money, but that will likely get old one day. Don’t sell your soul for student loan debt, slaving away at a nine-to-five job for the rest of your young years. Stay free, and spend your money on financial freedom. You’ll thank yourself later.