It seems like I can’t get through the day without hearing about Bitcoin. Whether it’s someone talking about their Bitcoin investment, or an article about the current price of Bitcoin skyrocketing.

Even Elon Musk is getting in on Bitcoin investing. Tesla invested $1.5 billion into Bitcoin, and the company announced it would start accepting Bitcoin as a payment for its products.

Unless you’ve been living under a rock, you too have likely heard of the cryptocurrency Bitcoin.

So What is Bitcoin?

You’re probably here because you’re thinking about investing in Bitcoin and want more information.

Before thinking about investing in Bitcoin, it’s important to actually know what you’re investing in. Bitcoin is a digital cryptocurrency that was created in January 2009 by a mysteriously anonymous person named Satoshi Nakamoto.

Satoshi Nakamoto’s intent behind Bitcoin was to create a purely peer-to-peer version of electronic cash that would allow online payments to be sent directly from one party to another without going through a financial institution.

Have you ever been annoyed with the $2 ATM fee when pulling out cash? Or the 3% “convenience charge” when using your credit card? Yeah, me too. These annoyances are a thing of the past when it comes to using Bitcoin. Transactions made with Bitcoin can be made without a middle man (or woman) – meaning, no banks! There are little to no transaction fees when using Bitcoin.

Not only can you buy a Tesla with Bitcoin, but you can also book hotels on Expedia, buy Xbox games, and even purchase furniture on Overstock.

Bitcoin isn’t tied to any country or subject to regulation. So no more worrying about exchange rates when going to another country!

Bitcoin Investment: What Determines the Price?

The price of Bitcoin is determined by supply and demand. Bitcoins are introduced into the market by a process called “mining”. Similar to mining gold, a person can mine for Bitcoins by verifying Bitcoin transactions.

If you want to know more about mining you can find out here: How Does Bitcoin Mining Work?

The rate at which new coins are introduced is designed to slow over time and is capped at 21 million Bitcoins. As of today 88.734% of Bitcoin has been issued.

The price of a Bitcoin is determined by how many Bitcoins are available and the price a person is willing to pay for a Bitcoin. Simple, right?

So now we know what drives the price of Bitcoin. Let’s look at some of the advantages to investing in Bitcoin.

Investing in Bitcoin: Advantages

One of the advantages to Bitcoin is that there is less inflation risk. Government currencies, like the United States dollar, lose their value over time as new money is printed. You can thank inflation for not being able to buy a Coke for 5 cents like our grandparents were able to. The limited supply of Bitcoin (21 Million), protects against inflation.

A second advantage is that Bitcoin is highly liquid. You can easily trade Bitcoin for cash or other assets instantly with little to no fees. If you’re looking to make multiple trades of Bitcoin this can be advantageous because you’re not goin to pay fees like you would with stocks. As an example, at Edward Jones, you’re charged a minimum of $50 every time you buy a stock.

Related: Edward Jones vs. Vanguard

Lastly, there are huge opportunities to make massive gains when investing in Bitcoin. Bitcoin and cryptocurrency are relatively new and therefore can produce unpredictable swings in price. If the price just so happens to go up while you own Bitcoin, you’ll be looking at a nice profit.

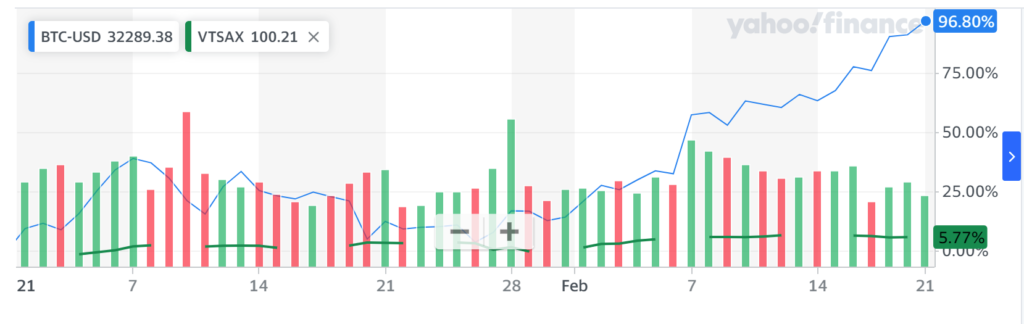

So far this year, the price of Bitcoin has risen by 96.8%! Compare that to my personal favorite index mutual fund VTSAX, which as only risen a measly 5.77%.

Bitcoin Investment: Disadvantages

The high volatility of Bitcoin that I previously mentioned, can also be a disadvantage. The Bitcoin market is constantly changing.

Just look at what happened December, 2017 The price of Bitcoin was $15,427. Three months later in March, the price fell by 50%. Are you able to stomach losing half of your investment?

Another disadvantage is there is little to no regulation. Governments have made no clear stance on Bitcoin, and therefore could decide that Bitcoin is illegal tomorrow.

Because there’s no regulation, there’s also nothing that prevents Bitcoin creators from adding more Bitcoin into circulation. If Satoshi Nakamoto decides to create 21 million more Bitcoins tomorrow, the price will be cut in half.

And at this point, there’s only a few online merchants that accept Bitcoin. This may not matter to you if you’re just looking make a quick profit. But Bitcoin only holds value if it can actually be used. If more merchants continue to not accept Bitcoin for payment, it loses all value.

Investing in Bitcoin: How to Invest?

So you’ve reviewed the pros and cons, and you’ve decided you want to get in on the Bitcoin action. How do you actually invest in Bitcoin?

There are many places online where you can invest in Bitcoin and it’s similar to investing in stocks. The first step is to create an account with a company that allows Bitcoin investments.

A few of the top brokerages to invest in Bitcoin are eToro, Coinbase, and BitcoinIRA.

After you’ve created an account you can transfer funds from a bank and then start trading.

I saw that Coinbase was offering $5 worth of free Bitcoin just for signing up, so I took the cheese and created an account. It was relatively easy and painless. As an experiment, I will continually update this post with the results from my free $5 Bitcoin investment.

Is Bitcoin the Future?

I personally have a hard time seeing Bitcoin or any kind of cryptocurrency becoming a mainstream form of currency in the future. The only reason Bitcoin has value is if people believe that it is worthy to have value. There’s nothing backing Bitcoin as currency except the people.

If you do decide to dabble in Bitcoin, I recommend using less than 10% of your overall investment portfolio. In my opinion it’s too risky to invest any more than that. You’re better off investing in something that has a proven track record of continuous success.

So what do you think? Will you be investing in Bitcoin? Have you already? Do you think Bitcoin is the future?

Pingback: Edward Jones vs Vanguard: Which is Better? - Nine to Thrive

Thanks Aron! What are your thoughts on other cryptos, like ETH? I think BTC is really on so popular bc it’s the first mover. ETH offers more from a “contractual” standpoint which i think will make a bigger impact long term.

Also what do you think of BTC being an ETF? I think it’s pretty interesting to help integrate crypto into more traditional investing portfolios. Thanks again!