Have you ever wondered why retired people move to Florida? It’s not just for the warmer weather. Florida is one of the few states with no income tax – an attractive draw for people looking to reduce their cost of living.

So, why don’t more of us follow suit? Don’t worry, I’m not telling you to drop everything and move to Florida. But, when it comes to adjusting your cost of living, you have options!

Previous generations of people were typically stuck working in a single location for their entire career. Think about how hard it would be to find an out of state job before the internet. I literally just stopped and thought about it… it seems impossible…

Even researching a prospective place to live was a challenge. Before the internet, things like crime rates, average temperatures, and median home prices weren’t a couple Google searches away.

Lucky for us, those days are long gone. So why do so many of us succumb to our own current cost of living?

I understand family ties or a commitment to your current employer. But, perhaps you’ve never thought about this: By changing your location and, inherently, your cost of living, you could shave years, even decades off your path to financial independence.

When looking to reduce your cost of living, here’s what to look for.

Housing Prices

Of course, researching the housing market where you plan on living is a must. I’m a strong believer in owning a home rather then renting for the long term.

By doing a quick search on Zillow, you can find out what typical houses are selling for in the area that you’re interested in. As much as I’d love to live in Hawaii, given the cost of living and housing prices, it doesn’t make sense for me to move there.

A general rule of thumb for me is that a monthly mortgage payment should be less than 33% of your monthly take home pay.

An Example

In 2013, Janene and I were looking at relocating from Alaska to Washington. We had spent some time in Seattle during our honeymoon and fell in love with the area.

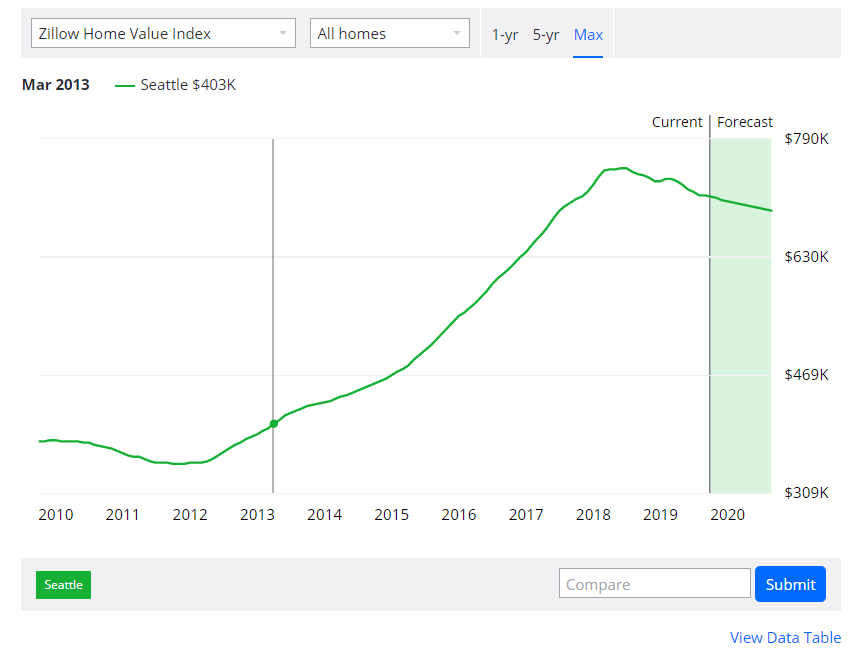

However, when looking at the housing prices in Seattle, they were well outside of our price range, even back in 2013. Looking at Zillow, the median house price in Seattle was around 400k. Our absolute maximum budget was 300k, so Seattle was not an option.

Instead of accepting that we’d never be able to relocate, we looked at other options. This is when we found Bellingham, WA.

In 2013 the median home price in Bellingham was around 250k (perfect!) Bellingham is 90 miles north of Seattle, but offered a lower cost of living and still had everything we loved about Washington.

Taxes

Another expense that can vastly change your cost of living is taxes. And in particular, state income tax.

Someone making $60,000 per year right out college that chooses a job in a high income tax state like Oregon versus a no income tax state like Washington will pay roughly $338,000 dollars in state income tax over a 45 year working career!

And if instead that money was invested in an index mutual fund like VTSAX, that same $338,000 could accumulate to $2.7 million dollars. This is what I mean when I say your cost of living can shave decades off your path to financial independence.

Some people will tell you that you should consider sales tax as well. When I lived in Oregon and asked people how they felt about the high income tax, almost always their response was, “Yeah, it’s not that bad, we don’t have sales tax!”

Uh…are you kidding me right now? The only way that income tax is not as bad as sales tax is if you are spending every penny you earn. And with sales tax you can control how much you spend, therefore you can control how much tax you pay.

At Nine to Thrive we are striving for financial independence so we are definitely NOT spending as much as we make!

Okay rant over. You get the gist: Living in a state with low income tax can significantly reduce your cost of living.

Jobs

Once you find a place with housing you can afford, and taxes that are reasonable, it’s time to look for a job. This was the biggest struggle for me when looking at relocating. There’s a reason why there’s more people in cities. That’s where all the jobs are!

If you are currently working for a company that has multiple office locations, you should probably start there. Does your company have an office in a location with a cost of living that is significantly less than your current cost of living?

Most employers are flexible when it comes to their employees changing offices. Turnover is expensive, costing companies, on average, $15,000 per employee. At my current employer, there have been multiple people in the last year that changed office locations.

Another option is working remotely. If you’re capable of working remotely, it’s worth asking your employer if this is an option for you.

You can even negotiate a remote working scenario. I recently did this. I told my current employer that I’d be willing to take a pay cut if I was able to telecommute. My employer took me up on my offer, and now I’m able to work from home!

Making the Move

Okay, so you’ve found the perfect location to cut your cost of living, and you’ve nailed down a job. Now it’s time to make the move!

If you’ve found a job with a new company, they may pay for your moving expenses. However, if you’re moving costs aren’t covered, you’re probably wondering how much it costs to move out of state.

It’s actually cheaper than you may think, if you’re willing to take care of the move yourself. When Janene and I moved back to Bellingham from Portland we were able to cut the costs down from a $7,000 quote that a full service moving company gave us, to less than $500 by renting a Uhual and moving everything ourselves (with help).

So what are you waiting for? If you’ve always wanted to relocate, now is the time! With technology and our current working culture, companies are more flexible than ever when it comes to keeping their employees happy.

A move to a location with a lower cost of living can supercharge your path to financial independence. That’s something to think twice about!