Recently, I dusted off the old tax returns and looked as far back as my spreadsheets go in order to relay our financial journey thus far. This post will cover our path to financial independence from its infancy to its current state. You’ll get a glimpse at our salaries, how much we’ve invested, and what our net worth has been since we graduated from college.

When I first mentioned the idea for this post to Janene, she replied “Should we share all that!?” I understand her reservations. I’m about to get real personal with ya’ll. But, I think it’s important to show the actual numbers to prove that financial independence is possible on “nine to five” jobs.

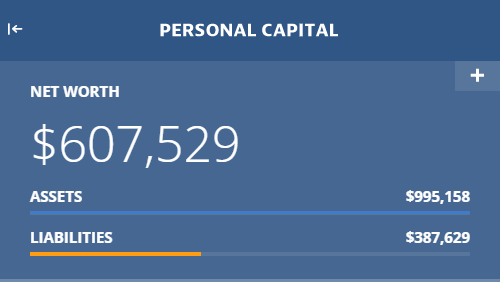

Our Path as of July 2019

The figure above is from our Personal Capital account. We use Personal Capital to track our net worth. It’s free, and I highly recommend using it.

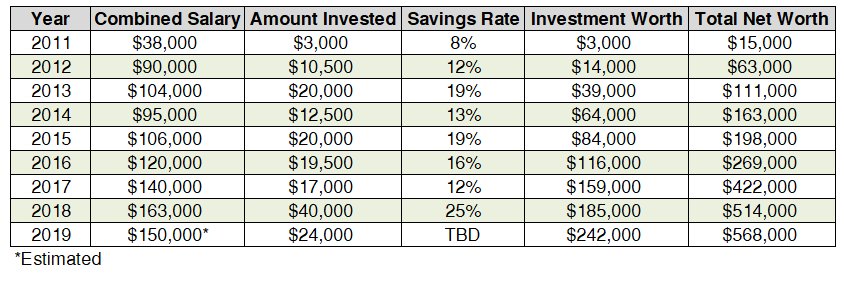

The table above is a snapshot of our salaries, investment worth, and total net worth from when we graduated from college to today.

The “total net worth” column includes money in our investment accounts, bank accounts, and health savings accounts as well as our house and rental property values (minus the mortgages and fees that would incur if we sold our house and rental property).

Note that that the total net worth value shown in the Personal Capital account doesn’t take into consideration the fees associated with selling real estate, which can be expensive.

I’ve estimated what our salaries will be in 2019 since we are only in July. The rest of the numbers for 2019 are current.

I’ll give you the run down of our journey, starting from the beginning:

2011

In 2011, Janene graduated in April with a degree in radiologic technology. Three months later, she landed a full time job at the hospital in Fairbanks, Alaska. I still had one year left of school.

The summer of 2011, I worked as an intern at the University’s power plant making $14.75 an hour. In the fall I was hired by the local electric utility as an intern making around $22 an hour.

With Janene’s full time position and me making decent money as an intern, we found ourselves with enough money to start an investment account. At a time of life when most people are tens of thousands of dollars in debt from student loans, we were able to invest our first $3,000 in an IRA. By the end of the year our net worth was $15,000.

At this point, I didn’t have any plans of reaching financial independence or retiring early. All I knew was that I should start investing as early as possible to have money for retirement someday.

2012

I graduated in May with a degree in electrical engineering, and I was hired full time at the utility I had been interning at. The utility had amazing benefits. They doubled my contributions up to 6% of my salary for my 401k, and they offered a killer pension plan.

Janene continued to work at the hospital. Her job had a more standard 401k match of 4%.

We saw our salaries soar. Our first years of marriage, we were making next to nothing. Suddenly, we were making close to six figures.

In 2012, we invested $10,500 into retirement accounts, and started saving for a down payment on a house. By the end of the year our investments were worth $14,000 and our overall net worth was $63,000.

I still had no plan for financial independence at this point. The main goal was saving enough for a down payment on a house.

2013

This was a year of big change for us. We decided we couldn’t handle the cold, dark winters of Fairbanks, Alaska anymore. In October, we left our jobs and life behind for a new adventure in Bellingham, Washington.

The move to Bellingham definitely set us back financially. My new salary was about 15% less, and my new job offered a 401k contribution between 3%-7% of my salary (depending on how well the company did). Oh, speaking of 401k contributions….remember the amazing double match my previous employer was making to my 401k? That money had a vesting period of 3 years, so I forfeited that money when I left. Same goes for the pension. Oh well….

Janene had difficulties getting her Washington radiologic technology license, so she went from September to the end of the year without a job.

Despite our setbacks, we crossed the six figure salary milestone for the first time this year! And we invested $20,000. The stock market saw huge gains in 2013, and our total investment worth jumped to $39,000. We continued saving money with hopes of buying our first house. By the end of the year our net worth was $111,000.

2014

Janene was able to start her job at the hospital in Bellingham in January. It was a per diem position (as needed) without benefits.

That May, we bought our first house! We paid $310,000 for it. All our savings paid off and we were able to slap down a 20% down payment, avoiding the extra cost of PMI (private mortgage insurance).

2014 was a big year for our financial journey, because this is the year I found Mr. Money Mustache‘s blog. He writes about how he reached financial independence and retired at age thirty after only working his “nine to five” for 9 years. Mr. Money Mustache inspired me to begin our own financial independence plan.

Our combined salaries dipped below six figures this year. This can be attributed to my salary reduction and Janene having a part time position. By the end of the year we invested $12,500 – down from the previous year. I also received stock options at my company which did well, so our investment worth was up to $64,000 and our total net worth was $163,000.

2015

After finding Mr. Money Mustache the previous year, I did the math to project when Janene and I would reach financial independence. I determined that, if we boosted our savings rate to 20%, we would be retire by our early 50’s.

We continued with our jobs, and increased our savings rate to almost 20%. The stock market saw no gains in 2015. By the end of the year our net worth was $198,000

2016

In 2016, Janene got a benefited position at the hospital (YAY!). My job moved their office closer to Seattle, so my 30 minute commute turned into an hour and thirty minute commute.

Podcasts helped me get through the extra two hours of driving each day. After listening to most of the real estate podcasts from Bigger Pockets, my eyes were opened to the possibilities of rental properties as passive income. I spent the later part of the year getting things in order to buy a rental property.

In 2016, our savings rate dropped a bit. Mostly because I was wanting to save money for a rental property. We were still able to invest $19,500. The stock market was back up again in 2016, and the Bellingham housing market was doing well so our home value rose. By the end of the year our net worth was $269,000.

2017

2017 was a big year for us because we bought our first rental property. We made a few offers on duplexes in Bellingham; but, with housing prices rising, we were priced out of the market.

Janene grew up in Ketchikan, AK and her dad is a real estate agent there. After being unsuccessful in Bellingham, we found an awesome deal on a duplex in Ketchikan for $249,000 – our first investment property!

The property needed some work. We spent a couple weeks in Alaska putting in new floors, painting, replacing the counter tops, and doing some much needed landscaping. After spending around $14,000 to fix up the place, the property appreciated in value to $300,000 (up $51,000).

We were able to rent out both sides immediately. One side rents for $1,200 per month and the other rents for $1,400 per month. Janene’s dad manages the duplex for us, and the property generates a little over $1,000 per month in passive income.

We put less towards retirement accounts this year ($17,000), but our net worth soared because of the duplex purchase. By the end of 2017 our total net worth was $422,000.

2018

2018 was a tough year for me. At the beginning of the year I struggled with depression. The company I worked for was downward spiraling, and my commute was taking its toll. I would come home feeling totally helpless and lost. My marriage suffered. I knew I needed a change.

In May 2018, I quit my job and accepted a position in Portland, OR. Janene was hired at a hospital working the night shift. Shortly after starting my new position in Portland, I found out that my previous office was shut down (talk about good timing!).

Instead of selling our house in Bellingham, we decided to rent it. We managed the property ourselves and made a small $200 monthly profit from rent.

Our savings rate went up to 25%, however the stock market had a down year. Our house in Bellingham appreciated considerably, and our duplex in Ketchikan also saw modest appreciation, so our net worth grew to $514,000.

2019

This is the year I started this blog, and the year I started to get serious about financial independence. When you’re working for someone else, you can never rely on your paycheck to always be there. Things can happen that you have no control over.

Instead of retiring in my early 50’s, I wanted to supercharge this plan and retire at 40. So I created my fail safe early retirement plan. In 2019 and beyond, my goal is for our savings rate to be 40%. I’d also like to buy at least two more rental properties before 40.

2019 is also a year of another move. We’ll be moving back to Bellingham in August. After spending a year in Portland, we decided the big city life isn’t for us. I negotiated with my employer to work from home, and Janene was hired back at her previous job.

Reaching Financial Independence

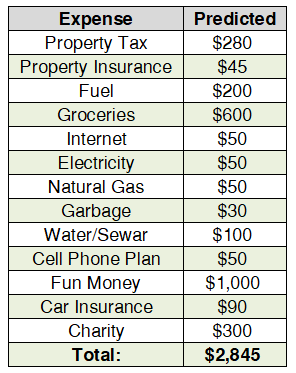

Using our current budget as a metric, the table below shows our predicted monthly expenses during retirement. Note that we intend to pay off our house, so we’ll only have to pay property tax and insurance.

Using this budget, our total yearly expenses will be $34,000. For extra spending money, I’ve rounded this number up to $40,000 per year for retirement.

If you’ve read my fail safe plan for financial independence, you’ll know that if we use a 4% safe withdrawal rate, we’ll need $40,000/4% = $1,000,000 in investments to be financially independent. Having a combined salary of $150,000 per year and a 40% savings rate equates to investing $60,000 per year. Assuming an 8% rate of return, we should be financially independent by 38. My goal however is still to retire by 40. But I’ll be more than happy if we’re able to get there earlier than that :). See the forecasts below:

It’s important to have a solid financial independence plan. I hope that my readers will see how achievable it is with a “nine to five” job, and be inspired to start a plan of their own.