With all the talk of inverted yield curves and a recession coming in the future, you may be searching for a way to protect your investments from a stock market collapse. The All Weather Portfolio, created by Ray Dalio, is supposed to be able to weather any economic season, while providing steady returns over time. I first heard of the All Weather Portfolio while reading Tony Robbin’s book MONEY: Master the Game.

Alright, let’s get right in to it, shall we?

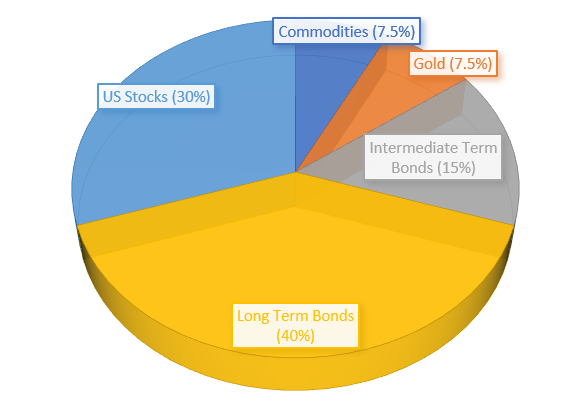

The All Weather Portfolio is made up of an asset mix that looks like this:

This formula produces a diversified portfolio that is meant to provide steady returns over time, no matter how the stock market is performing.

Take for example 2008, when the S&P 500 was down 37%. The All Weather Portfolio reportedly saw a loss of only 3.93% (I back test this later in the post). Say you had $100,000 invested in 2008. If all of your holdings were in stocks you would have lost $37,000. However, if you had the All Weather Portfolio, your losses would have been just under $4,000. Have I piqued your interest yet?

Who is Ray Dalio?

So who is this Ray Dalio guy? Ray Dalio is the founder of Bridgewater Associates. The firm is famous for its “Pure Alpha” fund. The Pure Alpha fund is reported to have lost money only three years during its 20 year existence, and has had an average annual rate of return of 12%. If you’re wanting to invest with Bridgewater, good luck, you’ll need a minimum of $5 billion in investable assets.

Dalio also predicted the 2008 financial crisis. In 2007 he warned the Bush administration that many of the world’s largest banks were on the verge of insolvency (inability to pay one’s debts.) When stocks plunged 37% in 2008, Dalio’s Pure Alpha fund rose in value by 9.5%. So basically, Ray Dalio is big time and knows his stuff.

That’s all good and well, but if you’re like me, you don’t have $5 billion dollars just laying around to have Bridgewater invest your money for you. So what are the common folk like me and you to do?

Creating the All Weather Portfolio

In the book Money: Master the Game, Dalio provides an asset allocation coined the All Weather Portfolio that looks like this:

- 40% Long Term Bonds

- 15% Intermediate Term Bonds

- 30% U.S. Stocks

- 7.5% Commodities

- 7.5% Gold

If you’re wanting to create this portfolio for yourself you could use the following funds:

- 40% Vanguard Long Term Bond Treasury Fund (VLGSX)

- 15% Vanguard Intermediate-Term Treasury Fund (VSIGX)

- 30% Vanguard Total Stock Market Fund (VTSAX)

- 7.5% PowerShares DB Commodity Tracking Fund (DBC)

- 7.5% SPDR Gold Shares ETF (GLD)

Back Testing Myself

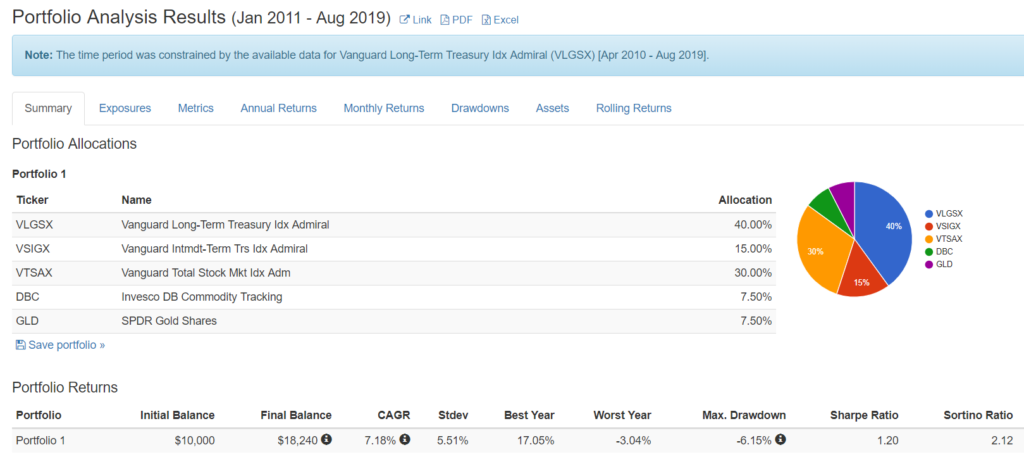

I back tested this asset allocation using the site Portfolio Visualizer. The results only go back to January 2011, which is the inception date for Vanguard’s Long Term Treasury Fund (VLGSX), but here’s how it’s performed:

When looking at the results above, I focus on the CAGR column (the annual rate of return) as well the worst year column. In this case, since 2011, the All Weather Portfolio has seen an annual rate of return of 7.18% and its worst year was -3.04%. Not too shabby.

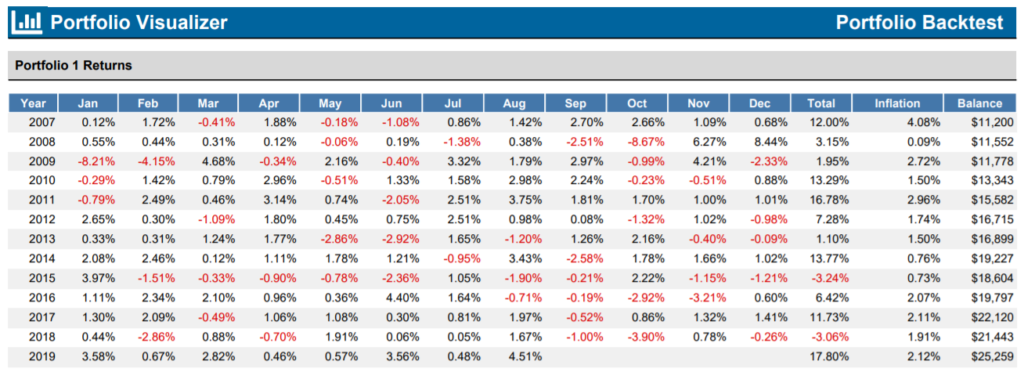

Because the All Weather Portfolio reportedly saw a loss of only 3.93% during the last recession, I wanted to back test this myself. To do this I replaced VLGSX and VSIGX with comparable funds from iShares: TLT (Long Term Bonds) and IEF (Intermediate Bonds).

Here’s how the All Weather Portfolio has fared since January 2007:

When looking in the “Total” column, it’s interesting to note that my version of the All Weather Portfolio actually saw an increase of 3.15% in 2008, during the recession. That’s pretty amazing.

The United States typically sees a recession every 10 years. With the last recession occurring in 2008-2009, we’re due for another one to hit. And it may be nice to have your investments protected from a stock market collapse by having a “recession proof” mix of investments such as the All Weather Portfolio

How is the All Weather Portfolio Recession Proof?

According to Dalio, we can expect four different seasons that the economy can go through that will affect your investment returns which are:

- Declining Economic Growth: When the Economy Goes in the Tank (2008-2009)

- Rising Economic Growth: When the Economy is Doing Well (Right now)

- Deflation: The Decrease in Prices for Goods and Services

- Inflation: The Drop in Value of Currency

The All Weather Portfolio is constructed in a way that it holds assets that have performed well no matter what season the economy is in. The result is a diversified, recession proof portfolio that provides consistent returns over the long run.

The All Weather Portfolio has only 30% of its holdings in stocks. Stocks are highly volatile. When trying to make a portfolio as risk free as possible, you’re going to want to eliminate volatility.

Bonds make up 55% of this portfolio. Dalio includes such a high bond mix because it counters the volatility of stocks. Having the majority of the portfolio in bonds further reduces risk.

Both gold and commodities are highly volatile, but combined they make up 15% of the All Weather Portfolio, and are both included to combat inflation. During periods of inflation, commodities rise in price. Gold is a “hard asset” and when currency depreciates gold will typically maintain or increases its value.

Back Testing the All Weather Portfolio During the Great Depression

In the book Money: Master the Game, Robbins back tests the All Weather Portfolio during the Great Depression. What he found was that this portfolio saw a loss of just 21%, while stocks saw a loss of 64%.

Furthermore, it was found that this portfolio has produced 9.72% annual returns between 1984 and 2013. During this 30 year stretch, the All Weather Portfolio only lost money 4 times, with an average loss of 1.9%. The worst down year was in 2008, with a loss of 3.93% (however, my version of the All Weather Portfolio actually saw a gain of 3% that year).

What I’m getting at here is, this portfolio is the real deal. It’s not some gimmick, that just so happened to work in one isolated incident. It’s produced almost 10% annual returns since 1984, while also minimizing risk during the last recession.

What to Do Moving Forward?

So what should you do moving forward? With all the doomsday talk saying we’re headed for the next recession, you may be looking for a way to minimize risk while maximizing returns. If that’s you, then I’d definitely recommend the All Weather Portfolio.

Personally, I’m okay with the risk of stocks. Stocks consistently outperform all other investments. Stocks may be more volatile, but if you buy and hold, you’ll be better off in the long term investing in stocks (but that’s just my humble opinion).

If you’re interested in Tony Robbins book Money: Master the Game, you can read my review here.