It’s time for an asset allocation battle between the FIRE (financial independence retire early) community’s most popular bloggers. I’m always curious to learn about different asset allocations. Recently, I compiled the asset allocations of the FIRE community’s top bloggers. We’re about to find out whose asset allocation comes out on top in this FIRE all star match up!

We’ll be taking a gander at the asset allocation from the following FIRE blogs:

- Mr. Money Mustache

- JL Collins

- Root of Good

- Millennial Money

- Millennial Revolution

As we go, I’ll discuss the pros and cons of each one, and then at the end, I’ll let you decide for yourself which asset allocation is best.

Up first we have the undisputed heavyweight champion of the FIRE community:

Mr. Money Mustache

I’ve been reading Mr. Money Mustache’s blog for years. When it comes to investing, his advice to his readers is “Just buy the Vanguard Total Market Index fund (ticker symbol VTI).” However, when it comes to his own investing, I haven’t seen him outline the details of his exact asset allocation. Probably because he’s got some kind of complicated secret voodoo asset allocation and he doesn’t want to over complicate things for his readers.

In the post The Betterment Experiment, Mr. Money Mustache invests $100,000 with an asset allocation of 90% stocks and 10% bonds. The advantage of having bonds in your portfolio, is that it helps smooth out the wild ride of the stock market.

Although, this probably isn’t the asset allocation he uses for the rest of his investments, it’s the only information I have, so that’s what we’re going to use. For this analysis I’ll use Vanguard’s VTSAX for stocks and VBTLX for bonds.

Up next, the investing guru known in the FIRE community for his stock series:

JL Collins

In JL Collins’ book The Simple Path to Wealth (which I highly recommend you read if you haven’t already), JL Collins talks about two phases of life: The Wealth Acquisition Phase and the Wealth Preservation Phase.

The Wealth Acquisition phase is when you are working towards retirement. And the Wealth Preservation phase is when you begin to live on the income from your investments.

Because most of us are working towards retirement, I’ll use JL Collins asset allocation for the Wealth Acquisition phase, which is 100% stocks. For stocks JL Collins recommends using Vanguard’s total market mutual fund VTSAX.

A 100% stock allocation is as aggressive as it gets when it comes to investing. But over the long run, no other investment has shown to provide better returns than stocks.

And now the person who was able to pay only $150 in income tax on a $150,000 salary, Justin from Root of Good:

Root of Good

I first heard of Root of Good this past year while listening to the Financial Freedom podcast. Justin’s tax optimization story of only paying $150 in income tax, inspired me to use the same strategies in my own life.

Related: My Biggest Financial Independence Mistakes

Justin gives his exact asset allocation in the post: Snapshot of Root of Good’s Diversification and Asset Allocation. And it looks like the following:

- 11% US Large Cap (VLACX)

- 5% International REIT (WPS)

- 11% US Large Cap Value (VVIAX)

- 11% US Small Cap (NAESX)

- 10% International Small Cap (SCZ)

- 11% US Small Cap Value (VISVX)

- 6% US REIT (VGSIX)

- 20% Developed International (VTMGX)

- 5% Emerging Markets (VEMAX)

- 10% International Value (VTRIX)

If you’re like me, when you first looked at this, you said WTF is going on here?!

I’m always curious how people come up with their asset allocation. I’m sure Justin has a reasoning behind the madness of this mix, but for now it will remain a mystery.

In his asset allocation post, Justin realizes the complexity of his portfolio, and says his aim is to “squeeze out maybe an extra one percent of return by taking on a little more risk.”

Justin’s portfolio is made up of 89% stocks and 11% real estate (REIT). The added risk that Justin speaks to comes from the large international allocation. The majority of this portfolio’s holdings (50%) are in international stocks.

International stocks have a double dose of volatility. Not only are the companies themselves volatile, but so is the foreign currency that the international companies operate in.

We’ll see if the added volatility is worth it later on.

On to the author of “Financial Freedom” and the host of the Financial Freedom podcast where I first heard of Root of Good, Grant from Millennial Money.

Millennial Money

In the post I’m Lazy and Beat the Stock Market, Grant states that the “Millennial Money Portfolio” was able to beat the S&P 500 by 1.23% in 2016. That’s an impressive statement. 1.23% compounded over time can equate to hundreds of thousands of dollars in your retirement account.

Grant came up with his asset allocation by doing “a lot of research on Morningstar, the Bogleheads forum, and reading the best books on investing.”

His asset allocation looks like this:

- 0.5% Cash (CASHX)

- 0.8% International Bonds (PFORX)

- 2.2% US Bonds (VBTLX)

- 25.8% International Stocks (VTIAX)

- 60.2% US Stocks (VTSAX)

- 10.5% Alternatives (VNQ)

This asset allocation is a little less complex than Root of Good’s, but again, the reasoning behind the percentages here are left to the unknown. But since this is what Grant states he uses, we’ll run with it.

The 10.5% alternatives is made up of real estate. Grant also has a good chunk of his portfolio in international investments, along with a small portion allocated towards cash and bonds.

And finally, we’ll look at the author of the book “Quit Like a Millionaire“, Kristy from Millennial Revolution.

Millennial Revolution

In the book “Quit Like a Millionaire” Kristy says that she wanted to be a bit more conservative when it came to her investments. Her and her husband Bruce agreed upon the following asset allocation:

- 20% Developed Markets Stocks (VEA)

- 20% US Stocks (VTI)

- 40% US Bonds (BND)

- 20% Canadian Stocks (XIU.TO)

Out of all the portfolio’s we’ll look at in this post, Kristy’s asset allocation has the largest portion allocated towards bonds (40%). Because Kristy is from Canada, she wanted a certain portion of her investments in the Canadian stock market. But she also wanted to take advantage of the U.S. stock market (VTI) while further diversifying herself with international stocks (VEA).

Now, the moment you’ve all been waiting for. Time to see how these asset allocations stack up!

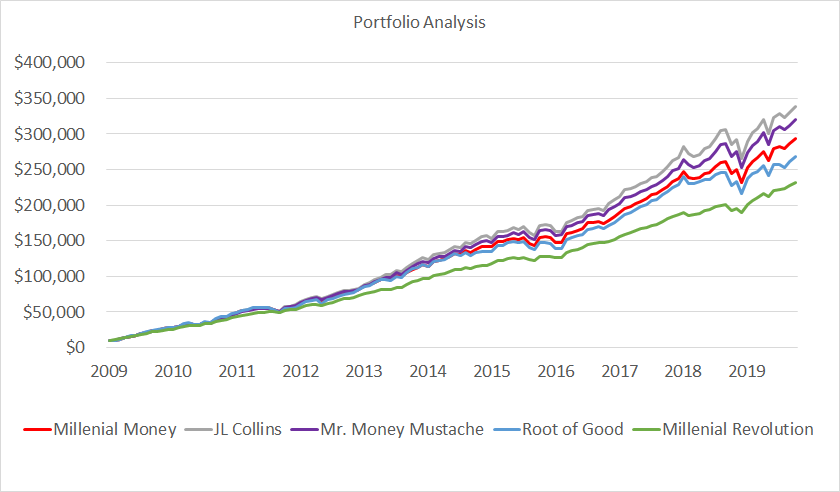

Analyzing the Portfolios

For this analysis, I wanted to go back at least 10 years. I’d like to go back further, but because of the complexity of some of these portfolios it was difficult to find funds that have an inception date of at least 10 years ago.

For the analysis, I used the site Portfolio Visualizer, and I used the following criteria:

- Start Year: 2009

- End Year: 2019

- Initial Investment: $10,000

- $1,000 contributed monthly

- Portfolio’s are rebalanced annually

- Dividends are reinvested

- Results are adjusted for inflation

And after punching in all the data, the results look like this:

Results

With a starting balance of $10,000, and a $1,000 monthly contribution since January 2009, each portfolio has accumulated to a value shown in the table below:

| FIRE All Star | Total |

| Mr. Money Mustache | $319,641 |

| JL Collins | $338,629 |

| Root of Good | $268,784 |

| Millenial Money | $293,566 |

| Millenial Revolution | $231,167 |

Here is each portfolio’s best year and worst year:

| Fire All Star | Best Year | Worst Year |

| Mr. Money Mustache | 29.96% | -4.66% |

| JL Collins | 33.52% | -5.17% |

| Root of Good | 33.28% | -11.15% |

| Millennial Money | 24.29% | -7.44% |

| Millenial Revolution | 18.99% | -5.60% |

What I find interesting in the above table is that all of the portfolio’s that are invested in international funds (Root of Good, Millennial Money, Millennial Revolution), have had the most volatility.

The simplest asset allocation was from JL Collins (100% stocks), and it performed the best over the last ten years. It was also the second least volatile. The Mr. Money Mustache asset allocation of 90% stocks/10% bonds performed second best and was the least volatile.

I’d like to make one remark about international investments. Many people will tell you that you should have a portion of your investments in international funds. But to me, the extra volatility isn’t worth it. Like I mentioned earlier, not only are you dealing with the companies/bonds themselves, but you’re also dealing with the volatility of the foreign currency. And when you invest in the largest U.S. companies, you’re inherently investing internationally, because the biggest companies in the U.S. do business overseas.

Final Thoughts

So what do you think? What asset allocation is best in your opinion? Which asset allocation do you personally use? Have you found an asset allocation that is able to beat simply picking a total U.S. market index fund?

Great post. I follow each of these bloggers and have taken away valuable insights from all of them. The portfolio visualizer tool is one of my favorites. I’ve been able to match the top performers here and slowly move 27% of my portfolio into us/int/muni/corp bond indexes through active rebalancing when the market hits new highs. The rest is in low fee total stock market index funds. I’m in the wealth preservation phase so I use 2008 / 2009 portfolio modeling to prepare to switch from stock sales to bond drawdowns and income in the event of a correction of over 20%. I hope to use bonds as a bridge during a longer term recession. “Everyone has a plan till you get punched in the mouth”

The 2009-2019 window definitely favored stocks so no surprise the all stock fund beat the 40% bond fund by a large margin. But we all, hopefully, have a longer time horizon so it would be more interesting to see this pattern over 30 years, which you can model somewhat in various online calculators. I suppose a related lesson is that starting with $10k and adding $1k a month for 10 years is going to result in some nice growth, regardless of asset allocation, as long as you invest regularly and don’t just leave the money in the bank.